After two full years of a bear market, crypto traders are commonly asking themselves “why is Bitcoin rising” once again. But the question has so many answers and underlying factors influencing the tides slowly turning from bearish to bullish, that a simple response just won’t do. Instead, there are a number of interesting points to make the argument that Bitcoin rising is something that will continue, and isn’t just yet another short-lived rally ready to be swatted down by bearish traders ready to short the top of each pump.

With so much going on causing Bitcoin to go up, here is a detailed list of the more important factors.

Bear Market Is Over

On December 17, 2017, Bitcoin reached an all-time high price of $20,000 after going parabolic and rising over 10,000% from trough to peak.

As the saying goes, “what goes up must come down.” And the powerful, year-long uptrend Bitcoin went on to suffer a massive, over 80% crash from the peak, resulting in a two-year-long bear market and crypto winter.

It’s said that bear markets end not when new buyers step in, but when sellers are exhausted. After two full years of selling Bitcoin, it has led to oversold conditions and sellers are beginning to dry up.

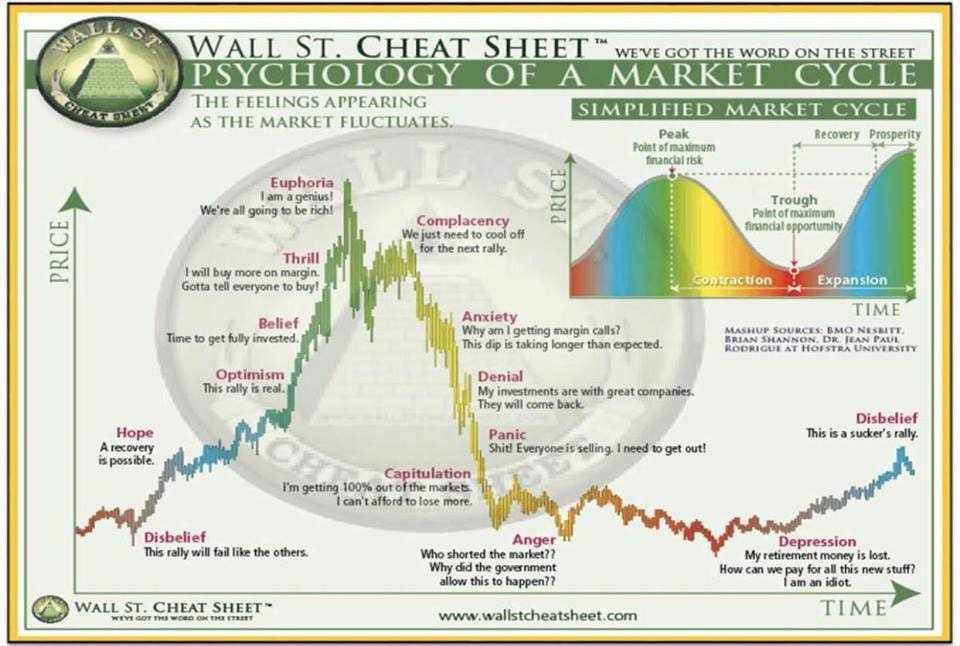

The one thing currently holding back a new bull run leftover from the bear market, is the psychological state crypto traders have been left in. Market psychology suggests that Bitcoin is currently in the disbelief stage when a new cycle is beginning but market participants have taken such a beating mentally, that they remain bearish until the asset takes off into an uptrend right under their noses.

Eventually, disbelief turns into hope, and a new trend begins.

History Repeats and New Cycle Begins

Markets are cyclical and history is known to often repeat. Bitcoin has been through a number of bear and bull cycles, each time rising from the grave and setting a new all-time high. Some even say that due to this, Bitcoin has actually been in a secular bull market. However, those who have experienced a crypto bear market would beg to differ.

Asset prices may have fallen by 80% or more, but each time this has happened in the past, Bitcoin has gone on to rise thousands of percent to set new highs and make investors an extreme amount of money.

With a new cycle potentially repeating, Bitcoin is likely to see some upside in prices as more and more people consider the bottom in, and a new uptrend possible.

And with the next cycle top possibly reaching price predictions of $50,000 to as much as $150,000, the opportunity is just too great to pass up. But the question remains “how does Bitcoin increase in value.” We’ll explain that in the next few sections.

Indicators Confirm Bull Market

Several indicators are confirming that a new bull market is underway. On daily timeframes, Bitcoin has broken through the Ichimoku cloud. On weekly timeframes, the MACD has turned up, and on the monthly MACD is close to breaking above the zero line.

The Average Directional Index also appears ready to make a run for the key reading of 25 signaling a new trend is in full effect. For now, the directional index lines have crossed which signals an uptrend in and of itself.

Parabolic SAR also has signaled that a new trend is beginning and showing signs of going parabolic once again.

Halving Is Coming

Bitcoin was designed to feature a number of key attributes and features that make it unique as a financial asset, but also as a disruptive technology.

Thecryptocurrency is hard-capped at a fixed supply of just 21 million BTC to ever exist, with millions less than that currently in circulation. The limited, scarce supply helps to give Bitcoin its value and make it a store of said value.

The fixed supply also gives the cryptocurrency a deflationary aspect, unlike fiat currencies that can be printed at the whim of a reserve bank.

More and more BTC is released into the market each day through a process called mining. Mining is what powers the Bitcoin blockchain, adding each new block and validating it. Bitcoin miners are paid, or “rewarded” for their efforts and upfront equipment and energy costs necessary for mining, by receiving 12.5 BTC.

But when the halving rolls around later this year, that reward gets reduced in half, hence the name.

The idea is that miners’ costs remain the same, but the cost to produce each BTC is increased. This supposedly causes miners to stop selling as much Bitcoin into the market at a loss, resulting in a dramatic shift in supply and demand dynamics.

This causes demand to outweigh the supply significantly until price catches up with the cost of production and miners begin selling again. It’s said that this has caused Bitcoin to go parabolic and start each new bull market, and could be the catalyst that triggers a massive Bitcoin rally in the days ahead.

Stock-to-Flow and Power Law Growth Corridor

Because Bitcoin is a unique asset unlike any other ever to exist and is the first of its kind, typical methods for finding an asset’s value – common fundamental analysis such as company revenue projections – doesn’t usually apply. Instead, analysts have attempted to model Bitcoin’s long-term value using the cryptocurrency’s hard-coded digital scarcity.

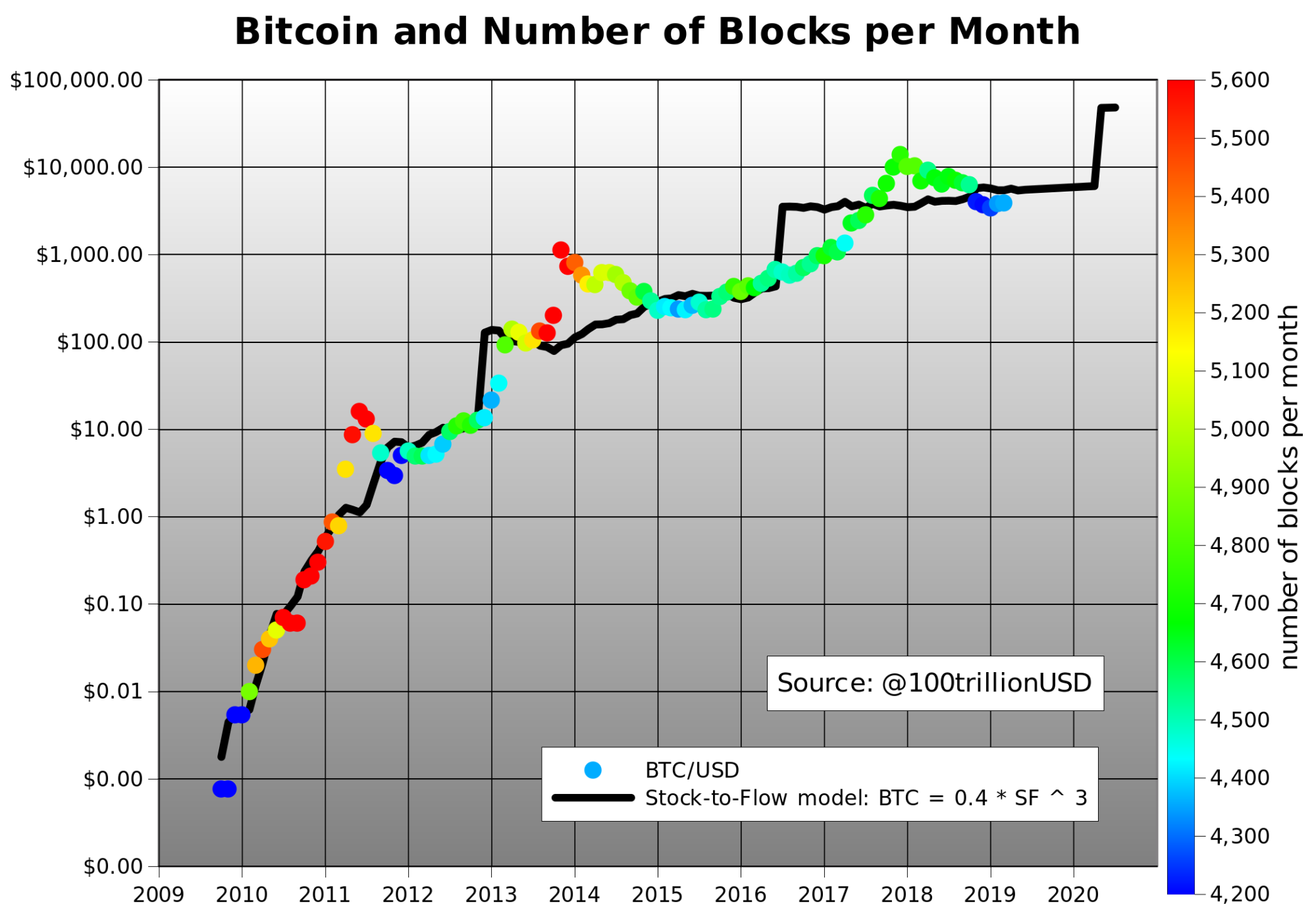

World-renowned Bitcoin analyst PlanB has published a paper dubbed Modeling Bitcoin’s Value with Scarcity and developed the highly cited Bitcoin Stock-to-Flow model. The Stock-to-Flow model has been widely discussed, even on TV series like CNBC’s Squawk Box.

According to the model, the “predicted market value for bitcoin after May 2020 halving is $1trn, which translates in a bitcoin price of $55,000.”

Recently, the model was further updated to account for one million BTC that are believed to be lost forever, further reducing the supply of 21 million BTC to ever exist. The 1 million BTC is said to be that of the cryptocurrency’s mysterious creator, Satoshi, Nakamoto, who disappeared years ago and has never been heard from since.

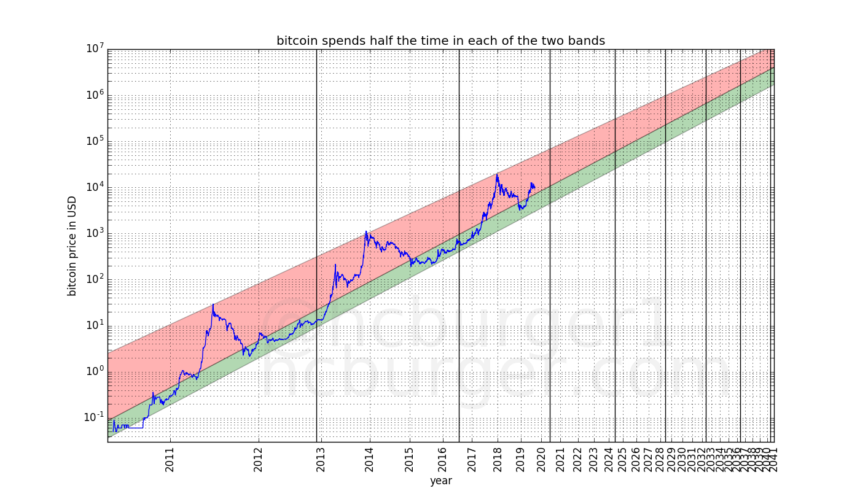

The Bitcoin Power Law Growth Corridor model also suggests that Bitcoin price will increase to astronomical figures in time. According to the model, Bitcoin price will reach “$100,000 per bitcoin no earlier than 2021 and no later than 2028. After 2028, the price will never drop below $100,000.”

Furthermore, it claims that “the price will reach $1,000,000 per bitcoin no earlier than 2028 and no later than 2037. After 2037, the price will never drop below $1,000,000” ever again.

With such incredible values projected for the cryptocurrency, the asset’s price is likely to go up just based on speculation alone. And given the financial opportunity at stake here, who can blame traders for taking an early position in an asset that could go from under $10,000 per BTC to over $1,000,000.

Bitcoin To Replace Fiat Currencies

But even the creator of the Stock-to-Flow model understands that anyone could be skeptical of Bitcoin reaching such high prices. They explain:

“People ask me where all the money needed for $1trn bitcoin market value would come from? My answer: silver, gold, countries with negative interest rate (Europe, Japan, US soon), countries with predatory governments (Venezuela, China, Iran, Turkey, etc), billionaires and millionaires hedging against quantitative easing (QE), and institutional investors discovering the best performing asset of the last 10 yrs.”

With quantitative easing slowly decreasing the buying power of fiat currencies, and as reverse banks feverishly print more money to delay an economic disaster, they’re only delaying the inevitable collapse of fiat currencies.

Making matters worse, debt is skyrocketing to the highest levels the world has ever seen and the gap between the wealthy and the lower class is growing exponentially.

The Only Answer To All Of This Is Bitcoin

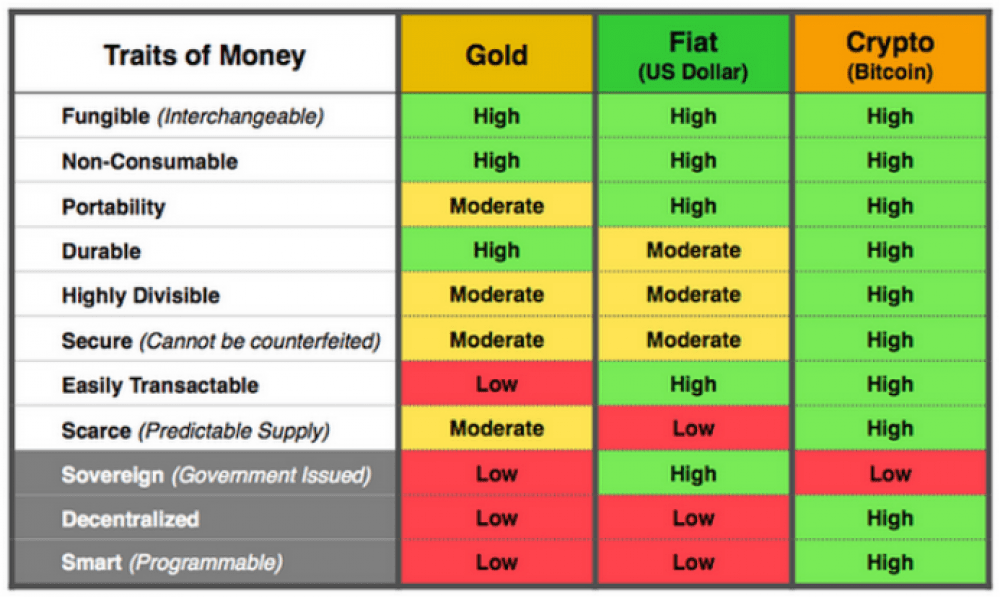

Bitcoin was designed by Satoshi Nakamoto in the wake of the last financial crisis and bank bailouts and did so with certain attributes in mind such as scarcity and a lack of ability to create more Bitcoin.

This deflationary aspect could cause a flight to Bitcoin from collapsing fiat currencies, causing its market cap to balloon to include much of the world’s wealth.

And as the world becomes more globalized, having a central reserve currency that is outside any single country’s control is extremely valuable. It also makes things like exchange rates and paying for goods while traveling that much easier.

Only time will tell if this occurs, but Bitcoin was designed to eventually unseat and replace fiat currencies, and no other asset has ever had a chance to do so – until now.

Bitcoin Becomes Safe Haven Asset

As fears over economic collapse increase and tensions between the world’s superpowers grow, more and more investors and traders are looking more towards safe-haven assets like gold and silver.

Interestingly, Bitcoin was designed to share many attributes with these precious metals, earning it the moniker of digital gold. Bitcoin improves on most aspects of gold by making it much easier to store, send, or trade. It also cannot be counterfeited, something that plagues the gold market even today.

The fact that Bitcoin and gold share similar features has caused the two assets to rise in tandem throughout 2019, and into 2020. The two assets have been skyrocketing all of 2020 thus far, ignited by the potential war between the United States and Iran.

As more investors fear the worst is coming, more and more could look to Bitcoin as a store of value, a great investment, and a safe-haven asset in the face of turmoil.

Institutional Interest Is Growing

Because of all of the aforementioned reasons, institutional interest in Bitcoin and other cryptocurrencies has been growing for some time now but has had one major missing ingredient: platforms that cater to institutional investors and traders.

CME Group and CBOE both introduced Bitcoin futures at the end of 2017, but lack of interest caused CBOE to end the desk last year. However, at the end of last year, volume on CME began increasing to the highest levels in some time, and the parent company of NASDAQ, Intercontinental Exchange, debuted their first-ever Bitcoin trading desk called Bakkt.

And while that platform launched to little interest as well, volumes have been surging and it’s a sign that it should continue to grow into the future as the cryptocurrency market heats up once again.

Institutional investors are now considering the asset alongside gold as a safe-haven asset, looking at it as an eventual alternative to fiat currencies, and realizing the amazing profit potential it wields due to its digital scarcity.

What To Do When Bitcoin Is Going Up?

When Bitcoin is going up, the crypto community has dubbed it “buy the dip season.”

This means that after reach pullback, the right move is to buy or go long and ride the uptrend to the next major resistance level.

But first, it’s a wise idea to consider performing detailed technical analysis with charting software to discover signals that can confirm a new uptrend is beginning. As mentioned earlier in this article, many indicators have flipped bullish, a new uptrend is likely right around the corner.

1. Going Long

The best trading strategy to profit from an uptrend is to go long. A long order is simply a buy order of an asset, usually with leverage.

Traders are advised to go long with each pullback, retest, and confirmation of resistance turned support, and ride the rally to new highs.

Stop losses can be set below the support level on a price chart, in case the uptrend ends and a new downtrend begins.

2. Trading With Leverage

Long trades can be opened with leverage, multiplying positions sizes by up to 1000 times. Leverage allows traders to gear their trades so they can generate even more profit from the same initial capital.

Leverage trades can greatly multiply the gains of a bull run. For example, if Bitcoin rose from $10,000 to $100,000 as many models predict, and the trader opened a long at 100x leverage, it would result in an $810,000,000,000 gain. The same spot trade without leverage would have earned the trader just $90,000.

We have also published a guide on more detailed Bitcoin trading strategies, for those interested in learning more advanced skills.

Conclusion

There you have it – the answers to “will Bitcoin go back up” and “why is cryptocurrency going up.” While there are plenty more reasons why Bitcoin is going up currently and why Bitcoin will rise in the future once again, this list covers the very most important reasons and explains them in full detail.

Armed with this knowledge that Bitcoin is going up and after learning more advanced Bitcoin trading strategies, you can sign up for a free account on cryptoapexpro and begin going long on Bitcoin at 100x leverage to maximize your gains. The platform also offers CFDs on stocks, forex, commodities, and more.

The platform features built-in charting tools to perform technical analysis and look for the best opportunities to long each pullback and close at each resistance level or when the asset becomes oversold using the RSI, MACD, or other tools.

In addition to leverage, charting tools, and more, cryptoapexpro also offers advanced order types such as stop-loss orders and take profit orders, allowing traders to minimize risk and maximize gains at each profit opportunity.

In no time at all and with careful planning, traders of the platform have been able to turn even small initial deposits into a fortune quickly, effectively, and safely.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of cryptoapexpro. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. cryptoapexpro recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.