Natural gas is one of the most important energy sources that is used for industrial, domestic, and power-generating purposes. It’s formed deep beneath the earth’s surface and is one of the cleanest energy sources based on fossil fuel. Here, we’ll explain everything you need to know to start trading natural gas online.

What is natural gas trading?

Natural gas trading refers to speculating on the future price movements of natural gas. Traders who think the price goes up would buy a natural gas contract, while traders who think the price goes down would short-sell natural gas.

Natural gas trading refers to speculating on the future price movements of natural gas.

Popular ways to trade natural gas include natural gas CFDs, futures and options contracts, and natural gas-related stocks and ETFs. Each of them has its own pros and cons, which will be explained further below.

When trading natural gas, it’s important to always have strict risk management in place. Natural gas prices can be quite volatile, reaching their peak during winter months and the heating season, and forming a bottom during summer months. Having a stop-loss in place will help you avoid large and unexpected losses while trading natural gas.

World’s largest producers of natural gas

Natural gas can be found deep beneath the earth’s crust, which makes its extraction somewhat complicated. Extraction companies typically use a process known as hydraulic fracturing, also known as fracking, where water and chemicals are forced deep into the earth in order to push the natural gas out.

The United States has first started using the fracking technology, which helped it take the leading position among the major natural gas producers in the world.

| Rank | Largest natural gas producers | Production in cubic meters (billions, 2017) |

| 1 | USA | 734.5 |

| 2 | Russia | 635.6 |

| 3 | Iran | 223.9 |

| 4 | Canada | 176.3 |

| 5 | Qatar | 175.7 |

Why trade natural gas?

As a major energy source that is environmentally friendly, demand for natural gas has grown rapidly in the last few decades. Traders who want to bet on the “green economy” of the future could do so using natural gas contracts with a long-term outlook.

Natural gas is also an important player in industrial usage. A growing number of companies are switching from oil to natural gas to power their operations. Cars can run on natural gas instead of petroleum and diesel, making it a cheaper and cleaner energy source for the transportation industry.

- Demand for environmentally friendly and clean energy sources has been rising for years

- As a scarce natural resource, natural gas can be used to hedge against inflation and depreciating currencies

- Natural gas tends to form powerful trends as demand picks up during the winter months and falls during the summer months

Why you shouldn’t trade natural gas?

Besides the advantages of trading natural gas, there are also reasons that speak against trading the commodity. Just like with oil, demand can quickly fall during times of economic recessions, which can send the price down. Exchange rate risks and other energy substitutes can also lead to falling prices in natural gas.

- Falling demand. Economic recessions can lead to lower demand for natural gas, which can in turn cause its price to drop. The Covid-19 pandemic and the global lockdowns are typical examples of what can happen when demand suddenly drops.

- Substitutes. Although the energy coming from natural gas is clean, there are even cleaner ways to produce energy nowadays. Solar and wind energy could become the leading energy sources of the future, which would lead to lower demand for natural gas.

- US dollar. Since natural gas is mostly traded in US dollars, any strength in the currency could weaken demand and the price of natural gas and other dollar-denominated commodities.

What affects the price of natural gas

The most important forces that affect the price of natural gas are supply and demand. Natural gas is a major energy source for electricity generation, industry, and residential heating. Here are the main factors that affect the price of natural gas.

Stored reserves of natural gas

Countries around the world store natural gas in large reservoirs which they can use in the case of rising demand. Those reservoirs are usually filled up during the summer months when the price of natural gas tends to be lower and depleted during winter months when the price of natural gas peaks on the market.

When countries use the gas in the reservoirs or refill it, this can have an impact on the spot price of natural gas.

Global demand

Global demand for natural gas has been steadily increasing in the last decade. In the coming years, market analysts expect that demand will rise by up to 2% per year, especially among the emerging economies in Asia.

The United States is still the top consumer of natural gas with an annual consumption of around 740 billion cubic meters in 2017. Russia, China, Iran, and Indonesia make up the remaining top 5 gas consumers in the world.

Alternative energy sources

Natural gas is a fossil fuel that is clean and better for the environment than oil and petroleum usage. However, it’s not the cleanest source of energy. Solar panels, wind turbines, and other renewable sources of energy are much greener and increasingly popular around the world.

Global consumption of renewable energy sources has been steadily climbing in recent years. Here is a chart that shows renewable energy consumption in terms of million tonnes of oil.

Weather

There are not many alternatives to natural gas when it comes to heating and electricity generation, especially when the underlying infrastructure has already been built for gas. Demand for natural gas usually peaks during the winter months as households and companies have a higher demand for heating.

Natural gas can also be in high demand during the summer months because it’s used by power generators to produce electricity. Hot summer months increase demand for cooling and air conditioning, which in turn leads to more energy consumption.

Supply-side conditions

Factors on the supply side include the production rate of natural gas, economic conditions, and the price of petroleum. The US fracking technology, for example, has added additional cubic meters of natural gas to the market, which helped in lowering its price.

Economic recessions are other factors that can lead to lower demand have a negative impact on the price of natural gas. Conversely, when the economy is booming, supply is often not enough to meet rising demand, which leads to higher natural gas prices.

Ways to trade natural gas

Natural gas can be traded with a wide range of financial products, including futures contracts, options contracts, and CFDs. Here’s a brief overview of the pros and cons of each of them.

Futures contracts

Natural gas futures contracts are traded on the Chicago Mercantile Exchange and are one of the most widely traded commodity contracts. A natural gas futures contract is an agreement between a buyer and a seller to exchange a standardized amount of natural gas at a pre-specified price and on a set date in the future.

Futures are often used by large speculators for trading purposes and by companies to hedge their exposure in the natural gas market.

Options

Unlike futures, options contracts on natural gas give the buyer of the option the right, but not the obligation to take delivery of a certain amount of natural gas at a pre-specified price and on a set date in the future.

Options are often used for speculation: if you think that the price of natural gas will rise, you could buy a call option, and if you think the price will fall, you could buy a put option. Your profit would be the difference between the strike price of the option and the current market price at the expiration date.

Contracts for Difference (CFDs)

Contracts for Difference, or CFDs, are the most popular financial product among retail traders. CFDs on natural gas allow you to take a leveraged position and increase your exposure in natural gas while allocating only a small portion of your account as a margin for the trade.

CFDs also allow you to profit when prices are falling by short-selling natural gas. CFDs are designed to track the price of the underlying asset, without the trader acquiring any ownership rights. So, if you want to actually take delivery of a certain amount of natural gas, you would have to buy futures or options contracts.

How to trade natural gas

Trading natural gas online is quite simple. All you have to do is open a live trading account, develop your trading strategy, analyze the market, and open your trade.

- Open a trading account: Opening a trading account is quick and easy with Crypto Apex Pros. Simply fill out our registration form (it takes less than a minute), deposit your funds, and you’re ready to trade as soon as your account gets approved.

- Develop your trading strategy: The next step is to have a well-round trading strategy. A good trading strategy includes everything you need to successfully trade a market, such as entry and exit rules, position-sizing, and risk management rules. This is a crucial step in becoming a successful natural gas trader.

- Analyze the market: Now that you have a strategy, it’s time to analyze the market. You can use technical or fundamental analysis for this, or any other tool that you might find useful in predicting the future price of natural gas.

- Open your trade: After your strategy and analysis shows you where the price of natural gas is likely heading, it’s time to hit the “buy” or “sell” button and your trade is open! Don’t forget to monitor your open trades and to keep a trading journal of all your previous trades.

What are strategies for natural gas trading

You’ll find hundreds of strategies for natural gas trading with a simple Google search. However, most of them can be broadly grouped into three main categories: day trading, range trading, and breakout trading. Here’s an overview of the most popular strategies to trade natural gas.

Day trading strategy

Day trading is a trading style that involves opening and closing trades within the same trading day. It’s a fast-paced and popular trading style among retail traders, as it allows them to get their trading results for the day by the end of the day.

The most popular day trading strategy is trend-following. This means you would buy natural gas if the chart shows an uptrend, and sell natural gas if the chart shows a downtrend.

During uptrends, the price forms consecutive higher highs and higher lows. Conversely, during downtrends, the price forms consecutive lower lows and lower highs. Look out for these signs, and you can easily identify the current trend of natural gas.

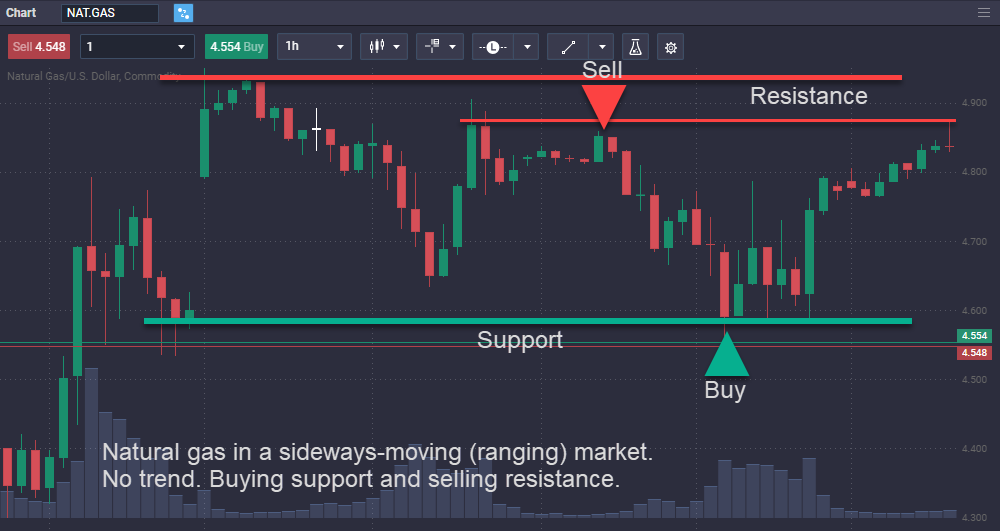

Range trading strategy

Range trading is similar to day trading as many range traders open and close their trades within the same trading day. Range trading means trading the range, i.e. buying when natural gas reaches the lower range support and selling when natural gas reaches the upper range resistance.

When range trading, it’s important that the market is not trending! If there are no higher highs or lower lows in the price chart, the market is likely ranging. You can also use technical indicators such as the Average Directional Movement Index (ADX) to determine the strength (or absence) of a trend.

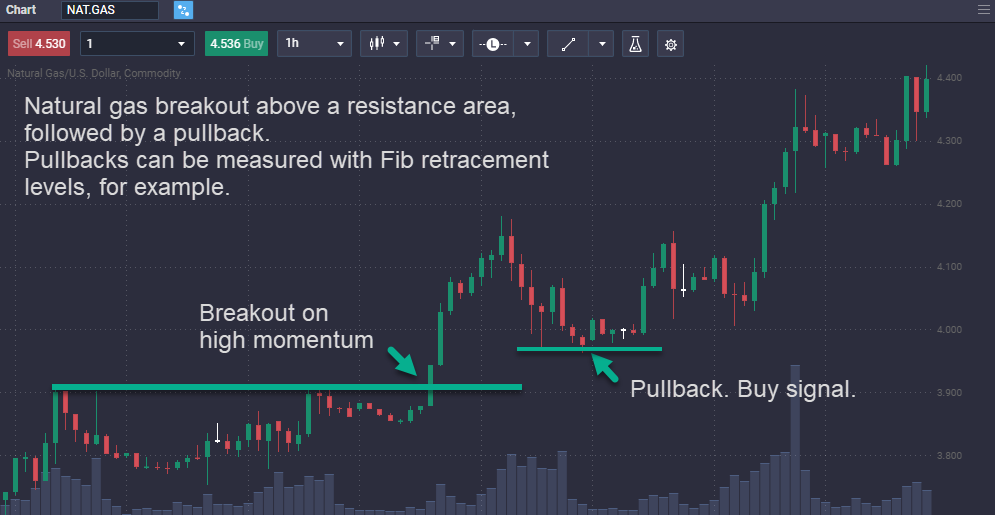

Breakout trading strategy

Last but not least, breakout trading involves trading breakouts in the market, i.e. situations where the price breaks above a previously-formed resistance, or below a previously-formed support level.

Breakout trading is extremely popular among retail traders, so it helps to get the basics of the strategy right. When trading breakouts, you can place your stop-loss just below the broken resistance level (when buying) or just above the broken support level (when short-selling).

Natural gas trading hours

Natural gas follows the trading hours set by the Chicago Mercantile Exchange. Trading starts on Sunday at 23:00 UTC time and ends on Friday at 22:00 UTC time. Those hours will shift between March and November as the United Kingdom and the United States change to and from daylight savings time.

Here is a table of the open market hours for natural gas for different timezones.

| Location | Trading hours |

| Chicago | 17:00 – 16:00 Sunday to Friday (CT) |

| New York | 18:00 – 17:00 Sunday to Friday (ET) |

| London | 23:00 – 22:00 Sunday to Friday (UTC) |

How to trade natural gas using technical analysis

Technical analysis is a powerful tool that helps traders anticipate future movements in the price of a financial instrument, including natural gas. Technical analysis is mostly based on chart patterns and the premise that history tends to repeat itself, i.e. we can get clues about future movements by looking at a price chart.

Technical analysis for trading natural gas

Natural gas traders who want to use technical analysis in their trading should be prepared to learn some of the most important chart patterns. Chart patterns are specific price formations that can often be used to anticipate the future price movement in a price chart.

They can be grouped into continuation patterns and reversal patterns, depending on whether they forecast a continuation of the underlying trend or its reversal. Here are the main chart patterns to learn:

- Continuation patterns: rectangles, triangles, pennants, flags, falling wedges during uptrends, rising wedges during downtrends

- Reversal patterns: head and shoulders, inverse head and shoulders, double and triple tops, double and triple bottoms, falling wedges during downtrends, rising wedges during uptrends

Advanced technical analysis

Traders who are already experienced with some basic technical analysis can also use some advanced technical tools when trading natural gas. Advanced technical indicators, candlestick patterns, and overlaid charts of correlated assets can provide valuable clues when trading natural gas.

Indicators such as RSI and MACD can be used to identify bullish and bearish divergences, which are powerful signals in technical analysis. A divergence occurs when the price of an asset moves in the opposite direction of an oscillator.

Finally, overlapping charts of positively and negatively correlated assets, such as the Dollar Index, Brent crude, or Russian ruble.

Tips for natural gas trading

Since natural gas is a commodity and a major energy source, it shares some traits with other energy commodities in the market. Here are some tips on how to get the most out of natural gas trading.

- Follow other energy markets: It’s important to keep an eye on other energy commodities, such as Brent crude and WTI. Natural gas will often follow the price of oil. Sometimes, divergences can occur (e.g. oil rising but natural gas falling in price), which can create attractive trading opportunities.

- Use stop-losses: Whether you’re a trend-following trader, breakout trader, or range trader, you should always use stop-losses in your trading. Natural gas can be very volatile at times, and stop-losses will help you avoid large losses during those times.

- Risk management: A vital part of your natural gas trading strategy should be your risk management rules. As a rule of thumb, you shouldn’t risk more than 2% of your trading account on any single trade (0.5% if you’re a complete beginner), and all your trades should have a reward-to-risk ratio of at least 1.5 (i.e., your potential risk is lower than your potential reward.)

- Follow economic indicators: Since natural gas is a major energy source for many industries, a booming economy will usually lead to higher demand for natural gas, which can in turn increase its price. By following an economic calendar, you can stay up-to-date on the most important economic indicators.

Why trade natural gas with Crypto Apex Pros

Crypto Apex Pros is a leading online broker that provides access to a wide range of tradeable assets, including Forex, cryptocurrencies, commodities, and stock indices. When trading CFDs with Crypto Apex Pros, traders are able to utilize the full power of margin trading with leverage ratios up to 100:1.

Competitive spreads, intuitive user interfaces, and award-winning trading platforms provide traders with all tools they need to start trading on natural gas and other financial instruments.

Crypto Apex Pros’s trading platform offers advanced charting tools, including fully-customizable technical indicators, trend-measurement tools, and position sizing tools that cater to both beginners and experienced traders.

If you’re a complete beginner in trading but still want to earn while you learn, Crypto Apex Pros’s Copy Trading module is the right tool for you. It allows you to automatically copy trades of successful traders while having full control over your risk levels.

How is natural gas sold?

Natural gas is mostly sold via futures contracts on the CME exchange. Large speculators and extraction companies use futures contracts to speculate on future prices and hedge their exposure, respectively. However, futures contracts also allow you to take delivery of natural gas.

Which indicator is best for natural gas trading?

Following supply and demand factors allow traders to anticipate where the price of natural gas is heading. During the winter months, natural gas prices usually peak and fall during the succeeding summer months.

Can I sell natural gas?

The best way to sell natural gas for retail traders is to use CFDs and short-sell on the market. This allows traders to profit from falling prices in natural gas.

Who controls natural gas prices?

Natural gas prices are under the control of the supply and demand forces of the market. When demand rises and supply falls, prices tend to rise, and vice-versa.

What time does natural gas start trading?

The market for natural gas opens on Sunday at 23:00 UTC time and closes on Friday at 22:00 UTC time.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Crypto Apex Pros. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Crypto Apex Pros recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.