Stocks posted a negative week with the Nasdaq hitting the biggest loser mark. The tech-heavy benchmark declined nearly 3%, while the Dow and the S&P 500 slipped by 1.7% and 1.9% respectively. All of that happened after the FED announcement on tapering – process of unwinding the massive purchases of Treasury bonds and mortgage-backed securities – happening at a faster pace amid a continued rise in inflation.

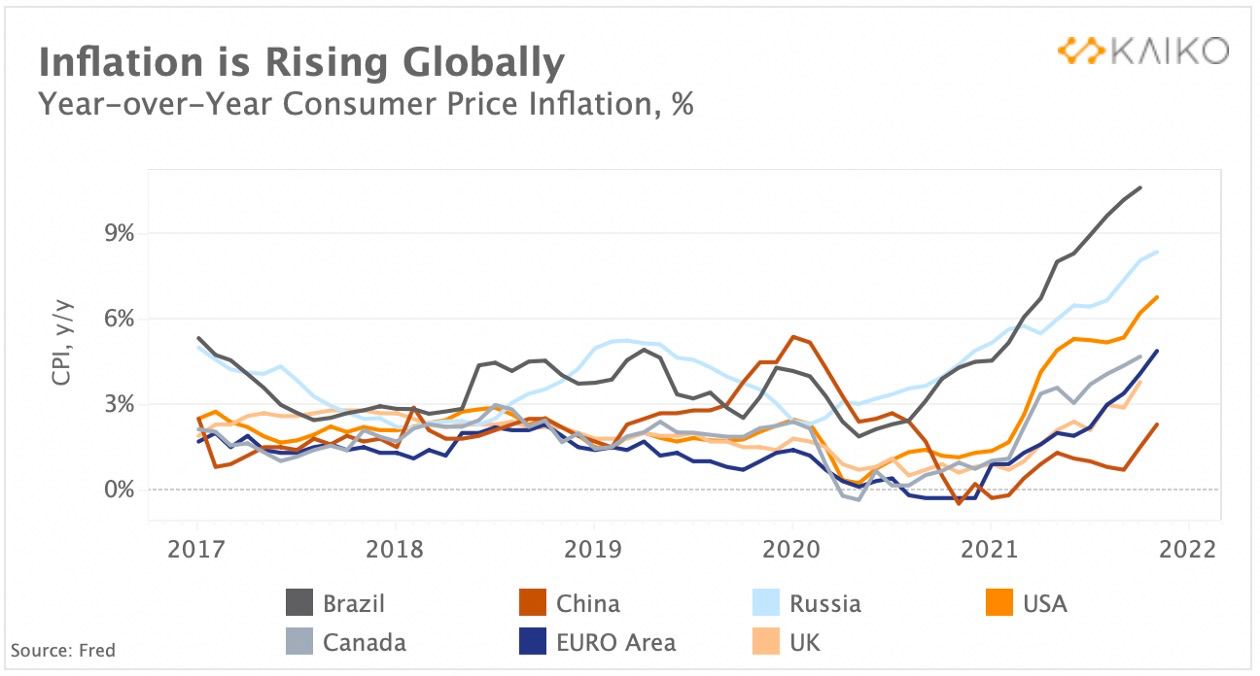

Growing concerns among economists that rising inflation could harm the economy are likely a big part of what led the FED to begin tapering.

Starting from January, the FED will be reducing the amount of bond buying by a third: from December’s rate of $90 million it will go down to $60 billion in January. The decrease will continue in the months ahead until March 2022 when all asset buying will cease. The FED also hinted at 3 interest rate increases of 25 basis points each by the end of the next year, which caused panic amongst investors in the midst of a worsening Omicron spread in the USA.

As a result of the latest FED decision, investors appeared to be rotating from high-growth tech names to consumer staples, while also reducing stock exposure.

Gold and Silver showed small relief rallies after the FED meeting, but retreated from their week’s high on Friday. Gold, in particular, had managed to go above $1,800, but closed the week at $1,799. Silver managed to stay above $22, closing the week at $22.40. Both metals rose for about 1% last week and are starting the new week an inch higher, with Gold trying to hold on to $1,800.

The demand for oil seriously decreased because reopening plans have been halted in many countries due to the surge in COVID cases once again. As a result, news about spiking COVID cases has dragged oil lower by almost 2% at the beginning of the week, this time crushing below the $70 psychological level.

The USD resumed its upward trajectory after the FED meeting confirmed hawkishness, moving back near its recent high – 97. However, the FED was not alone in its strategy, as England has already raised interest rates to 0.25% on Thursday, shocking many market watchers. However, the GBPUSD wasn’t affected greatly since most traders expected the USD to move higher in the days ahead as well.

The news of countries beginning to tighten monetary policies negatively affected crypto assets, which traditionally prosper in times of monetary easing. Hopes for BTC to reach $100,000 by the end of this year have been completely dashed as the leading crypto continues to drift lower.

BTC couldn’t hold on to any rebound that happened in the middle of last week and continues to slide lower, even at a greater pace after the FED announcement.

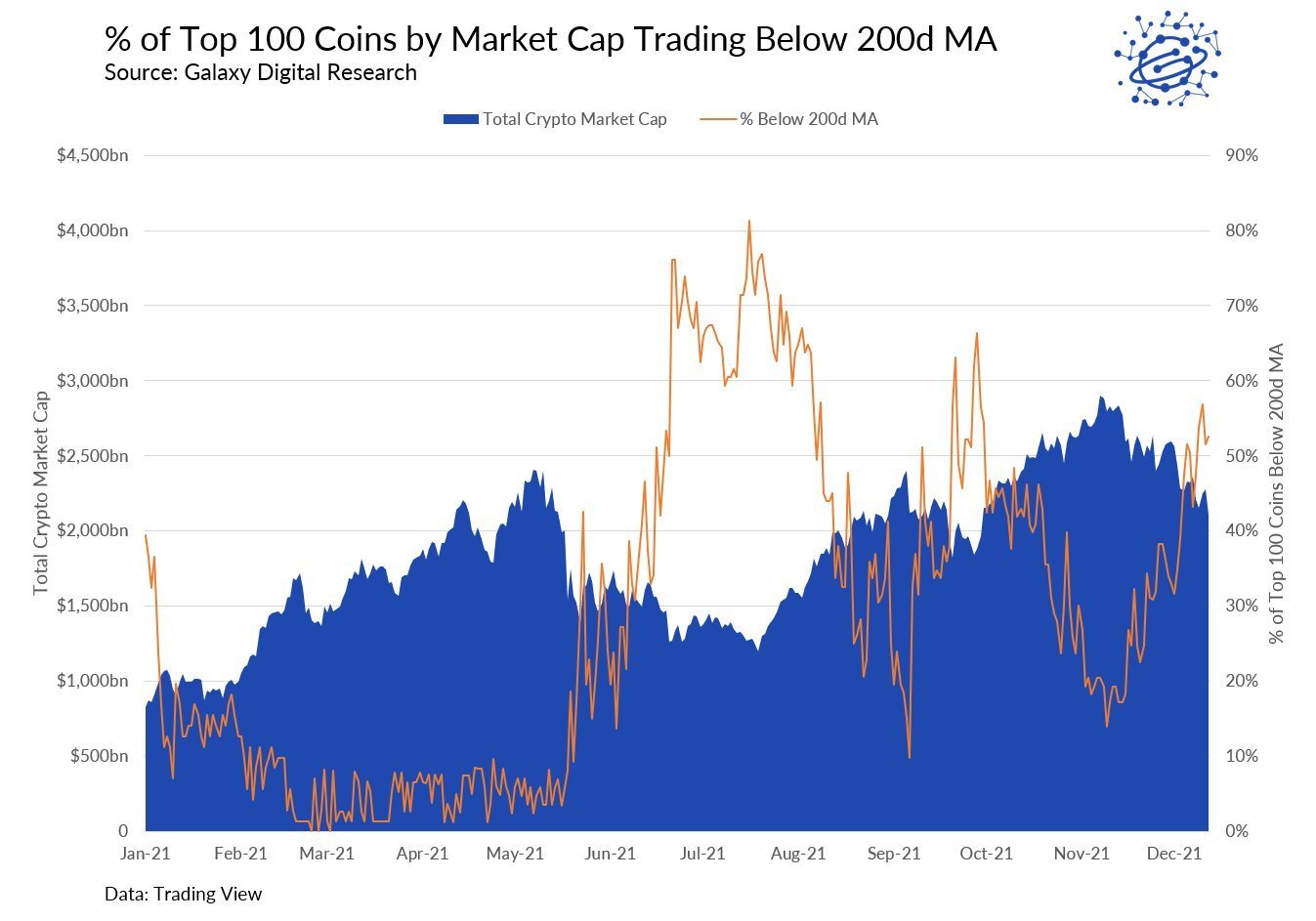

Half of Altcoins Already In Bear Market

With BTC looking weak, altcoins are reacting even worse, with many already trading in bear market zone. According to Galaxy Digital, 53% of the top 100 cryptos (by market cap) are already trading below their 200-day average, which is a clear sign of a bear market.

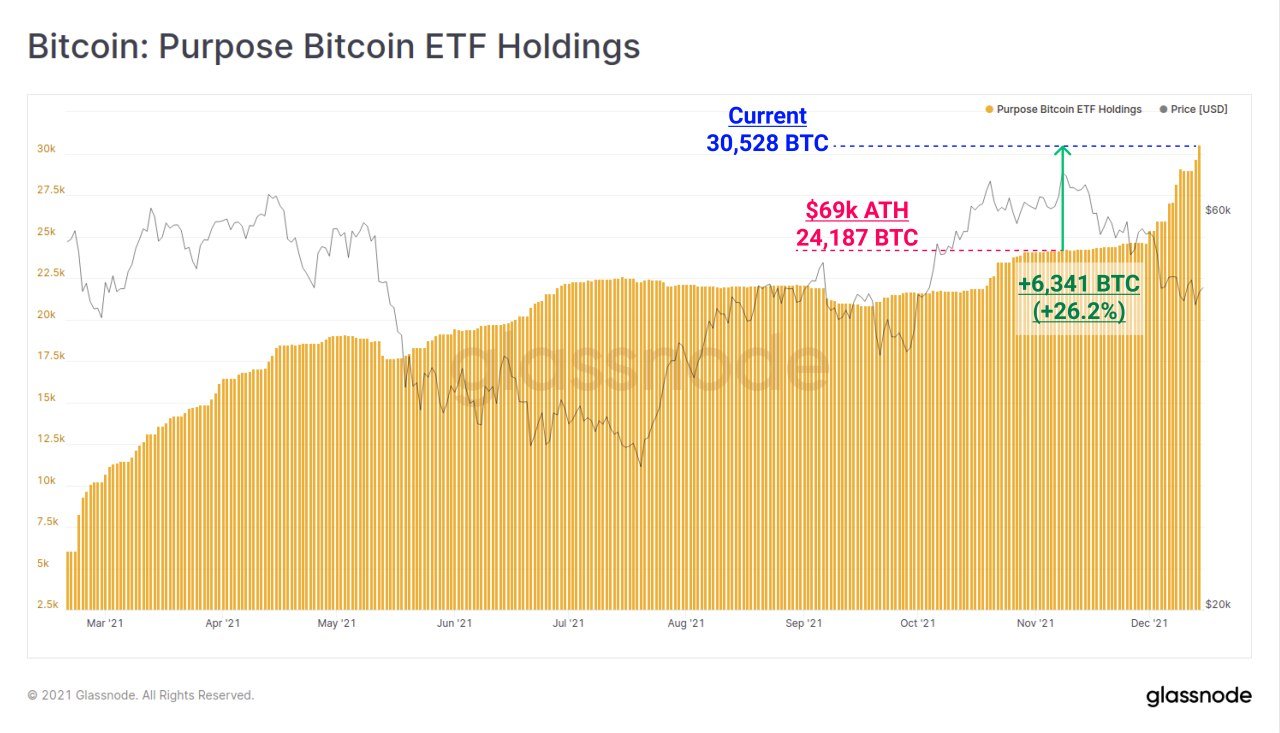

BTC Buying Persists Even As Price Continues to Weaken

However, despite the depressing market situation, many strong believers are still buying BTC as an inflation hedge despite monetary tightening measures in the major economies. Central bankers have warned that raising interest rates may not be able to fully curb the effects of inflation. As a result, many investors are still taking the dip opportunity to accumulate more BTC as an inflation hedge.

The data below shows that not only the accumulation of BTC is not weaning, it is actually on the rise.

For instance, the Canadian Purpose BTC ETF has added 6,341 BTC since December, showing a 26.2% increase in BTC holdings as the price of BTC fell by 34% in the past few weeks.

Another BTC ETF fund$ and 2.5 billion insurance company – Lemonade – also announced that it has added around $1 million worth of BTC to its balance sheet.

According to the managing director of the Mubadala Investment Company fund from the UAE State, which manages $243 billion in assets, the company has also started investing “in the ecosystem around cryptocurrency.”

Many state and sovereign funds dive into crypto assets as inflation continues to spike higher in 2021.

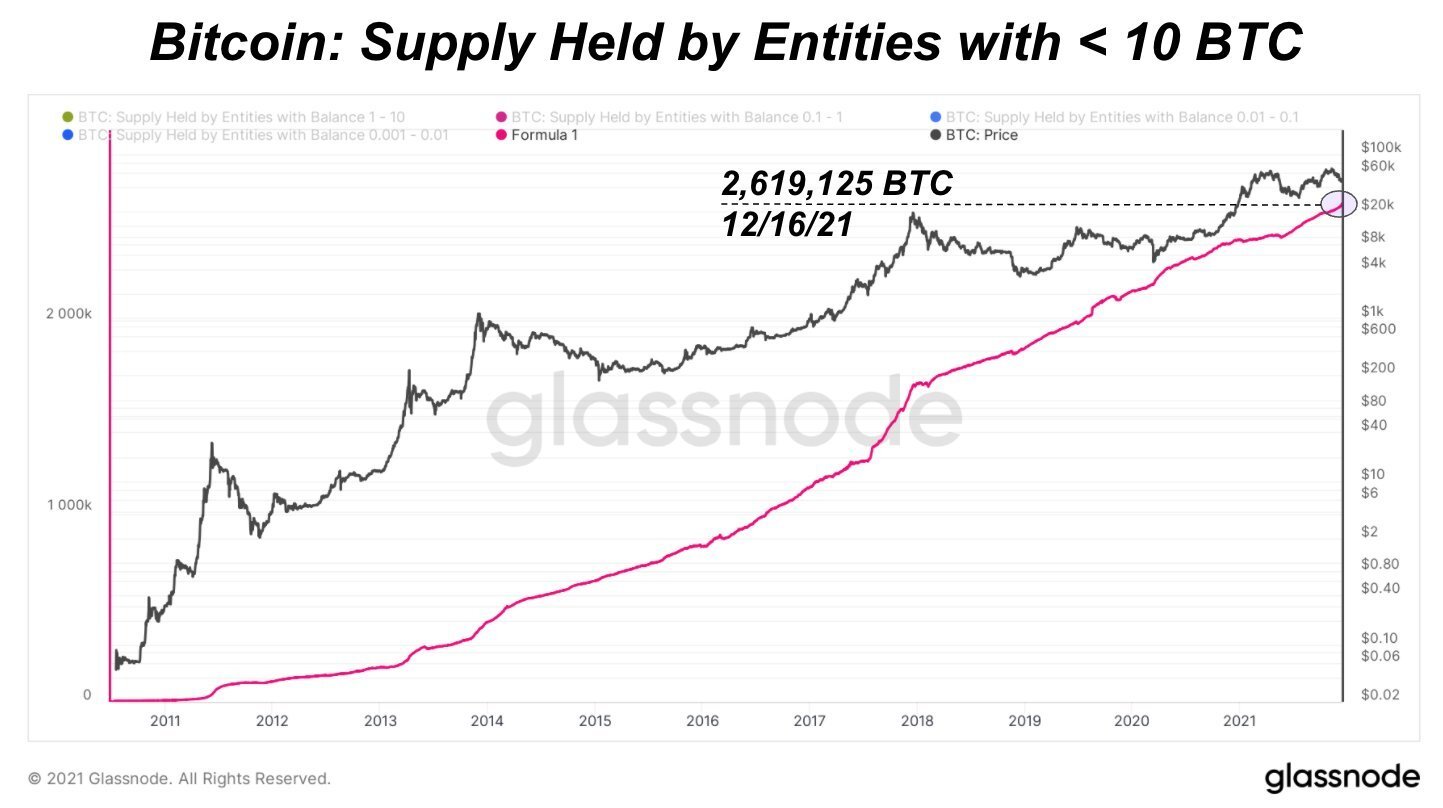

Apart from the large whales, smaller BTC whales (with less than 10 BTC) maintain adding BTC to their stash. This accumulation has been going on relentlessly regardless of the BTC price changes. Moreover, during the latest BTC dip, the purchase has picked up compared to the Jan-April period when the process plateaued out.

BTC Scarcity Could Be Reason For Continued Buying

Scarcity could be one of the reasons why investors are persisting in accumulating BTC.

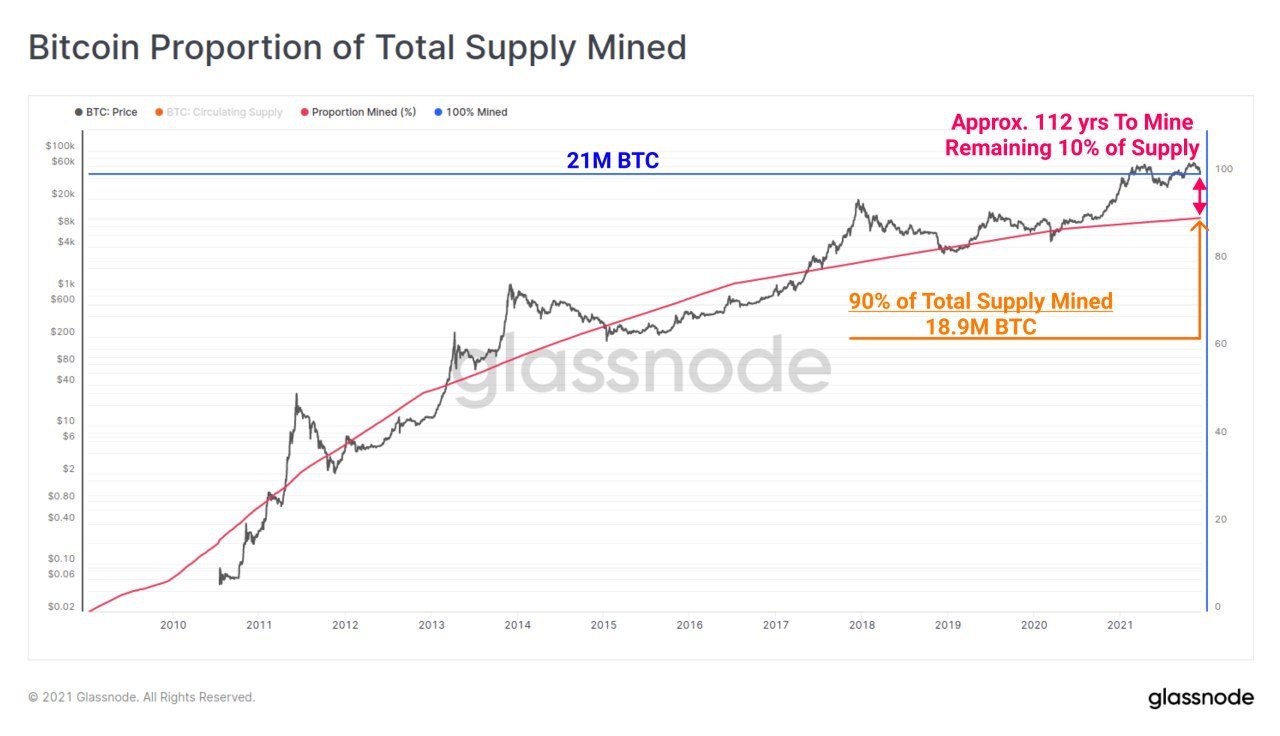

As of now, 90% of all BTC has been mined, making it increasingly difficult to acquire BTC through mining, as reward difficulty has just gone higher recently.

The current circulating supply of BTC is 18.9 million leaving only 10% of the anticipated total supply left to be produced — a process that will take decades to get close to the limit.

A lot of BTC has been “lost” — with some estimates as high as 3.7 million. With Satoshi’s 1 million BTC that they have not spent, it makes around 4.7 million BTC unreachable, resulting in the active circulating supply of 14.2 million. Compared to the world’s population of more than 7 billion people, it makes a tiny amount. Hence, this scarcity quality of BTC could continue to affect buyers until the day the BTC code can be broken and rewritten.

Accumulation Also Seen in ETH As Whales Continue to Hog

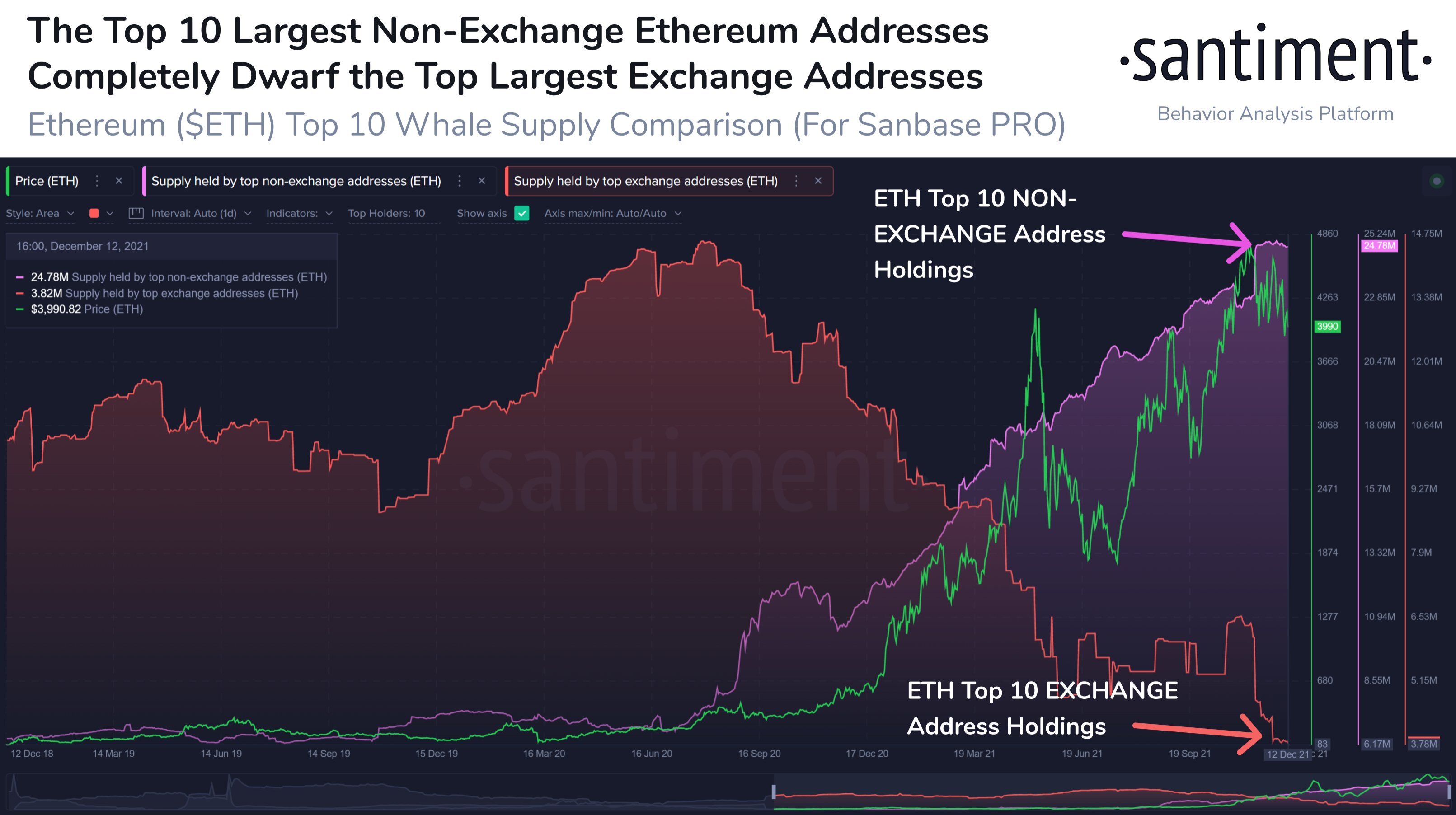

Exchange reserves of ETH continue to drop even as the price comes crashing in the past week. Currently, the 10 largest ETH addresses on exchanges hold a total of 3.82 million ETH, which is the lowest level during this bull run. Meanwhile, the top 10 largest non-exchange addresses hold a cumulative of 24.78 million ETH, – almost 8 times more than exchange reserves, – and are closer to the ATH of 26.63 million from June 2016. To summarize, whales continue to hog ETH instead of selling despite the weak price action.

Brief Excitement for DOGE As Elon Comes To The Rescue

It hasn’t been all gloom and doom in crypto land despite several negative headlines recently.

To start with, DOGE saw some support from the “DogeFather” with Elon Musk announcing on Twitter that Tesla will produce merchandise buyable with DOGE. DOGE surged close to 40% on the news, but could not keep up with the gains and lost more than half in less than 12 hours afterwards.

After Musk’s announcement, DOGE saw a big spike in transaction volume. An anonymous DOGE wallet sent 5.4 billion DOGE worth $973 million to two wallets. The first recipient wallet received 80 million DOGE worth $12.6 million, while the second received 5.3 billion DOGE worth $844 million. The transactions occurred just two hours after the Tesla announcement and led to speculations on whether those wallets belonged to Elon or Tesla, or whether a large whale is splitting his DOGE assets for transactions and safekeeping.

Regardless of who the whale is and why they were doing the transfer, on-chain data revealed that a day after Musk’s announcement – from 14 to 15 Dec – DOGE saw a 148% increase in on-chain transfers exceeding $100,000. Hence, this move by Tesla has indeed sent some ripples into the DOGE community, which should be put on investor’s radar as we get closer to the launch of the DOGE-1 mission slated to begin sometime in January 2022.

On another note, the SBI Group of Japan will be launching the first of its kind cryptocurrency fund for ordinary investors which will comprise of BTC, ETH, LTC, BCH, LINK, DOT and XRP.

However, despite news about Russia considering a ban on cryptocurrency investing in the country, thereby sending investor sentiment into new lows, the actual market situation is not as bad as headlines position it to be. With the last two weeks of the year approaching, institutional investors going on vacation could cause trading volume to fall, in turn causing volatility to go up on quiet, low volume trading. This may result in some good trading opportunities for the nimble and small retail traders.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Crypto Apex Pros. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Crypto Apex Pros recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.