DeFi, or Decentralized Finance, refers to financial services that are – decentralized. That is, DeFi aims to bypass traditional financial channels and middlemen, such as banks, and uses blockchain technology to make financial services available to everyone, everywhere. Here, we’ll cover DeFi staking, which is a popular way to earn passive income with tokens.

DeFi staking explained – Definition & Example

DeFi staking allows you to earn a passive income simply by holding a certain amount of eligible cryptocurrencies on DeFi platforms. The two most popular ways to earn income with DeFi are staking and yield farming.

In DeFi staking, participants add their tokens to a staking pool, and an algorithm chooses which miner (or node) validates the block and earns the rewards. Even though the node is chosen at random, users who have more tokens at stake have higher chances of being picked by the algorithm.

Staking has become extremely popular in recent times. Solana, for example, has more than $40 billion of staked coins that earn an average APY of 5.88%, at the time of writing.

It’s less resource-intensive than validating transactions with the Proof-of-Work mechanism, and users are able to earn an attractive reward for staking their coins. The reward – expressed as Annual Percentage Yield (APY) – is often higher than depositing funds in a traditional savings account.

Yield farming, on the other hand, involves lending your coins on a decentralized exchange. Here, you’re not acting as a validator on the blockchain, but as a liquidity provider to the exchange.

Decentralized exchanges offer many incentives to attract users to their platforms, one of which is quite high APYs. In fact, yield farming is more profitable than staking, most of the time. It’s also currently one of the most powerful drivers of the DeFi sector.

Types of DeFi staking

There are several different types of DeFi staking that generate passive income to investors. Staking is just one of them, with the other two (yield farming and liquidity mining) becoming increasingly popular.

Staking

Staking is the purest form of validating transactions on the Proof-of-Stake network. It involves locking a set amount of tokens and becoming a validator on the blockchain network.

Unlike with a Proof-of-Work network, where transactions are verified using expensive computational power, Proof-of-Stake networks rely on validators who have to perform their duties diligently – or risk losing a portion of their stake.

An algorithm chooses which validator gets to validate and adds a new block to the PoS network for a reward. Usually, validators with the largest stakes on the network have a preferential status for validating transactions and earning rewards.

Yield farming

Yield farming is a very popular type of DeFi staking where different investors move tokens to a DeFi platform in order to form a staking pool. This helps bypass the minimum deposit requirements of some networks, and all interest income and rewards are proportionally shared among all of the investors.

Liquidity mining

Liquidity mining is very similar to yield farming as it involves moving crypto assets and tokens to a DeFi network in order to form liquidity pools. Those pools are then used by Decentralized Exchanges (DEX) to enable decentralized trading (without any intermediaries), known as Automated Market Making.

Such a pool usually consists of two tokens that in turn form a crypto pair. The overall trading on DEX exchanges is based on the availability of liquidity providers and pools that facilitate trading activities.

How does DeFi staking work?

Earning interest with DeFi staking requires depositing eligible tokens into a DeFi protocol. Not all cryptocurrencies allow DeFi staking, such as Bitcoin for example. Bitcoin, the largest cryptocurrency in the world, uses Proof-of-Work which doesn’t support staking.

Other cryptocurrencies that do support DeFi staking, such as Ethereum, often have a minimum deposit requirement to become a validator on the network. Currently, the ETH2 platform requires a minimum of 32 ETH to become a “staker”, although this can be bypassed with the help of staking pools, which will be explained later.

So, when you stake your tokens on the network, those tokens are utilized to verify transactions on the blockchain (using the Proof-of-Stake mechanism). They act like collateral and a guarantee that a block of transactions is error-free.

The interest that you earn on your tokens is a reward for lending your tokens to the network in order to verify transactions. The node that gets chosen by the algorithm to verify a block earns the reward, and the new tokens are returned to the original investor.

Besides minimum deposit requirements for some networks, certain platforms also have a minimum holding period during which you can’t withdraw your tokens. This holding period is also called the locking or “vesting” period.

How does yield farming work?

Just like staking, yield farming allows you to earn interest on your crypto holdings. The main difference to staking is in the way how your coins are utilized by the platform. Yield farming involves lending your cryptocurrencies to liquidity pools on DeFi platforms, which are essentially smart contracts for holding your coins.

Decentralized exchanges (DEXs), such as Uniswap or Curve, depend heavily on liquidity providers. Since DEXs provide a decentralized way to exchange different cryptocurrencies, they don’t act as middlemen between buyers and sellers. Instead, they use liquidity pools that act as automated market makers (AMMs) and offer the automated exchange of coins.

If you lend your cryptocurrencies to a liquidity pool, you’ll earn interest. Each time traders exchange one coin for another on a DEX, they pay a fee, which is then redistributed to the different liquidity providers in proportion to how much liquidity they provide to the DEX.

What are the pros and cons of DeFi staking?

DeFi staking provides several advantages to investors. Besides the possibility of earning passive income, DeFi staking also comes with lower entry barriers and is usually highly secure. Here are the main advantages to start staking today.

Pros:

- Passive income – As mentioned, DeFi staking allows investors to earn interest on their tokens that are lent to the network. Earned interest with DeFi staking is quite attractive and higher than what you would earn with traditional financial institutions, such as banks. Some coins have Annual Percentage Yields (APYs) of more than 10%.

- Low entry barriers – Previously, we mentioned that some tokens have minimum deposit requirements. In the case of Ethereum, those amount to a whopping 32 ETH, which – at the current market price – isn’t quite cheap. However, you can start DeFi staking with shared staking pools, where a large number of individual investors add their coins to the pool to become more competitive on the network.

- Security – Since Decentralized Finance is based on Smart Contracts, DeFi staking is considered quite secure. All transactions on the blockchain need to be verified by miners, which reduces the possibility of fraud or corrupt actions on the network significantly. Once a Smart Contract is in place, there is almost no way to stop its execution if the contract’s conditions are met.

Cons:

- Price volatility – Cryptocurrencies are notorious for their extreme price volatility at times. It’s not uncommon for the price of a coin to move hundreds, or even thousands of dollars in a matter of minutes – especially during the announcement of important news.High volatility in the price can offset any interest earned with DeFi staking. The best-case scenario is that your coins increase in value while you also earn interest with staking, but that’s unfortunately not always the case. It helps to believe in a DeFi project in the long term before deciding to stake coins.

- Hacks and attacks – Despite the fact that blockchain networks are quite secure and new transactions are verified by all participants of the decentralized network, this doesn’t mean that cryptocurrencies are immune to hacker attacks. There have already been attacks on major exchanges, including Bitstamp and Coincheck.

What are the pros and cons of yield farming?

Just like staking, yield farming comes with a set of advantages and disadvantages. Let’s see whether yield farming has more pros than staking.

Pros:

- Passive income – Yield farming and staking are both popular ways to earn passive income on DeFi platforms. Just like staking, yield farming allows you to earn interest by lending your coins to an exchange and joining a liquidity pool. Many users switch from one DEX to another, looking for the highest APYs for lending specific coins. If you’re prepared to actively manage your “yield farm”, you may get higher rewards with yield farming than with staking.

- No locking periods – Many decentralized exchanges offer yield farming without a set minimum locking duration for your coins. This means you can decide how long you want to lend your coins and provide liquidity to the exchange – from a few days to multiple years. However, there is a major drawback here – gas fees. We’ll cover gas fees under the “cons” section of yield farming.

- Security – Just like staking, yield farming on popular DEX exchanges can be considered very secure. The main security risks arise on new platforms where scammers may take your coins and disappear. Developers are in control of the smart contracts that are designed to hold your coins. In 2021, a bug in a Compound Finance liquidity mining contract allowed hackers to exploit around $100 million worth of cryptocurrency.

Cons:

- Complexity – Staking is often considered simpler than yield farming because all you have to do is to decide on a staking pool and lock in your coins. With yield farming, users have to decide what coins to lend to what exchanges, taking into account many nuances along the way. This can be quite overwhelming, especially to beginners. Fortunately, platforms like cryptoapexpro take care of the complex parts of yield farming through different protocols and allow users to start earning interest with a single click of a button. All they have to do is choose a coin, and they’re ready to go.

- Gas fees – Yield farming pools offer attractive yield rates, but the rates have a tendency to change. This forces users to constantly look for alternative platforms to lend their coins to. However, to switch platforms, farmers have to pay gas fees when leaving or entering a new liquidity pool, which can reduce the potential profits of yield farming.

What are the models of DeFi staking platforms

Decentralized Finance staking is a fairly new concept, and staking mechanisms often differ from one platform to another. Today, there are usually three main models of DeFi staking, which are explored in more detail in the following lines.

Stablecoin DeFi staking platform

Stablecoins are coins that have lower price volatility than conventional cryptocurrencies. In other words, there are usually considered more secure and less prone to sudden (positive or negative) price swings, which is exactly what some investors are looking for.

In stablecoin DeFi staking platforms, liquidity providers stake those stablecoins against crypto assets, which are then offered to other users for lending by paying a commission to the platform. The commission is then redistributed to the original stakers.

Synthetic tokens staking platforms

Unlike stablecoin platforms, these platforms allow the issuance of synthetic tokens that are often linked to more traditional assets, such as gold, silver, or traditional currencies. Synthetic tokens staking platforms generate tokens representing a real asset, which are then offered as loans to other users for a commission.

DeFi staking aggregators

DeFi staking aggregators are platforms that aggregate several other liquidity pools and protocols in a single interface. Those aggregators are extremely helpful as they allow users to quickly compare several pools and protocols and pick the ones that best suit their investment goals. Examples of popular DeFi aggregators include Zapper and Zerion.

Important aspects of DeFi staking platforms

DeFi has emerged as just another buzzword in the crypto ecosystem, but the concept has gained a lot of traction in the industry. Choosing the right DeFi platform isn’t an easy choice, so here are some points that may help you in making your decision.

Graphical user interface

There is a growing number of DeFi platforms on the internet. To attract users, some of them try to build attractive and simple user interfaces, although this isn’t always an easy task given the underlying complexity of DeFi and staking.

When choosing a DeFi staking platform, make sure that its user interface is simple enough and intuitive. Dealing with private keys, staking tokens, adding to liquidity pools, and withdrawals of accrued interest have to be simple and effortless.

List of supported assets and their protection

As its name suggests, DeFi is decentralized and unregulated. This means, if you lose your funds for any reason, there is no authority that will refund your loss.

Fortunately, most DeFi staking platforms follow high standards of security, and the underlying blockchain technology makes it very hard for hackers to crack the system and steal funds. You could also create a smart contract on the network to make sure an agreement gets executed automatically once the contract’s conditions are met.

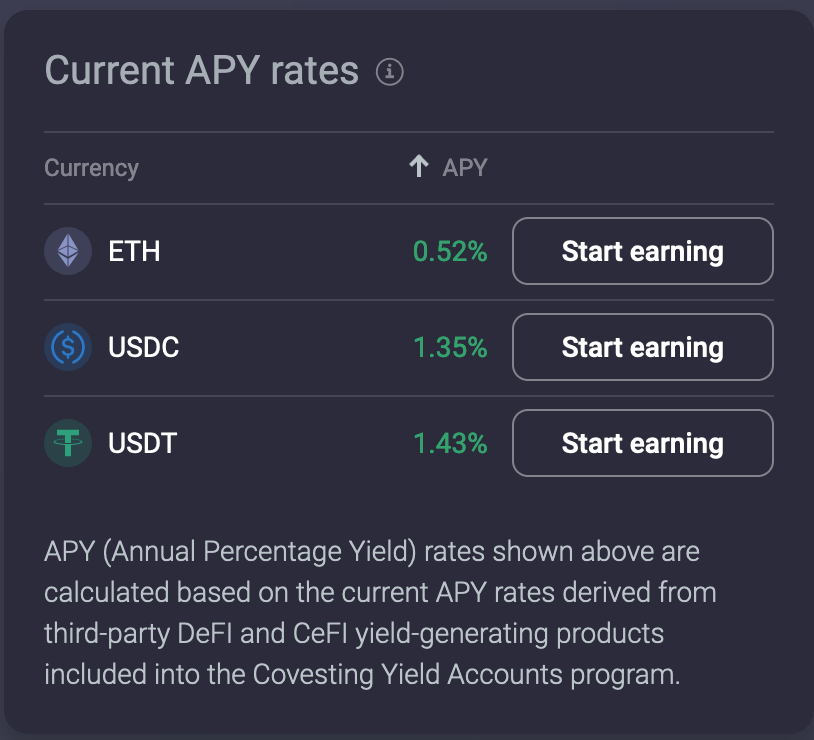

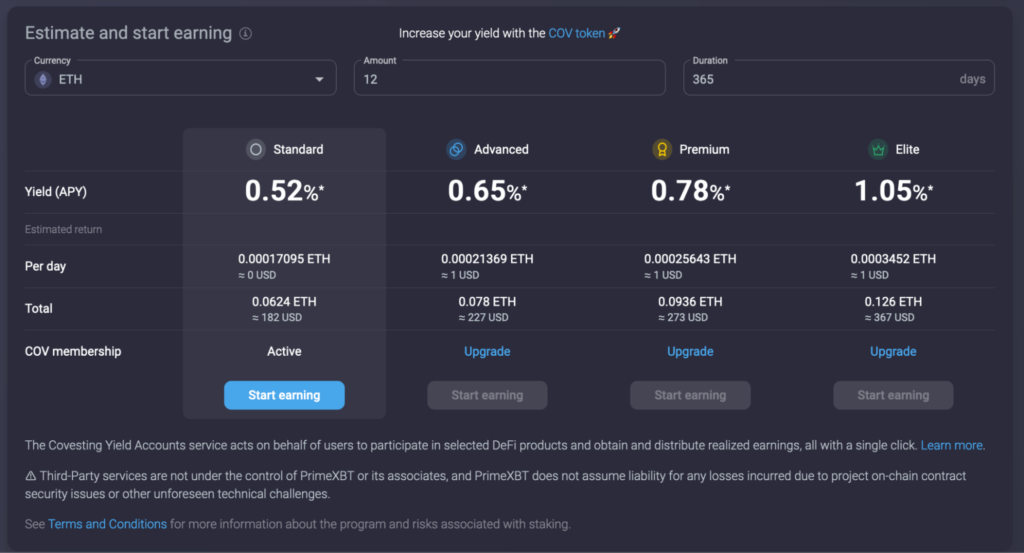

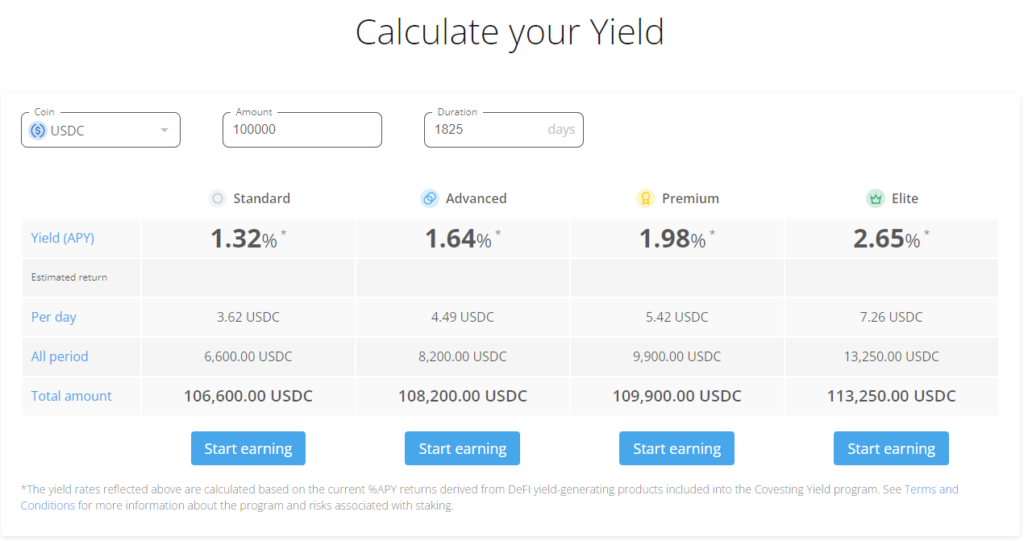

Rewards calculator

Investors who stake or lend their coins on a DeFi platform are doing so with one main goal: earn interest and make a profit. That’s why a rewards calculator would be a very useful tool that you can use to calculate your prospective earnings on a DeFi network.

Some DeFi platforms have an integrated rewards calculator on their website. There are many factors that influence how much you’ll receive from staking your coins, including the share of coins in the network, the volatility of the coins, and the time duration for which you’re locking your coins on the platform.

Payouts

Besides the profit that can be made with DeFi staking, users are also interested in the payout schedule and withdrawal procedures for specific networks. Before choosing a DeFi platform, make sure that the payout schedule fits your expectations and that your preferred withdrawal option is offered.

Conclusion

Decentralized Finance (DeFi) is a new and exciting way to earn passive income on your eligible cryptocurrencies. The popularity of DeFi staking is best described by the value of coins currently staked on various networks – dozens of billions of USD have already been invested in DeFi as of 2022.

To recap, there are two main ways to use DeFi to earn passive income: staking and yield farming. DeFi staking refers to staking your tokens to a Proof-of-Stake network, which are then used to verify and validate new transactions on the blockchain. Yield farming involves lending your coins to decentralized exchanges and providing liquidity.

In general, the more coins you have invested, the more you can earn on your coins. To improve competitiveness, smaller investors often pool their tokens into pools where any rewards are distributed based on the share of tokens each investor added to the pool.

Making a passive income with DeFi doesn’t come risk-free. Price volatility of cryptocurrencies, slashing events, and rug pulls can all have a negative impact on your potential profits. Advantages include passive income with attractive Annual Performance Yields (APYs) that are significantly higher than what traditional financial institutions would offer.

In addition, choosing the right platform for DeFi staking and yield farming can be overwhelming to beginners in the field. If you want to earn interest on your coins without having to worry about PoS, staking pools, liquidity pools, and different DEXs, take a look at cryptoapexpro’s Yield Accounts. Simply pick a coin and start earning today.

What is DeFi staking?

DeFi allows investors to earn passive income in the form of interest by staking their coins on a DeFi network or lending them on decentralized exchanges.

Unlike with Proof-of-Work networks, where miners use expensive computational power to verify blockchain transactions, DeFi staking is based on Proof-of-Stake networks where validators verify each new transaction. In yield farming, coins are not used to verify transactions, but to provide liquidity to decentralized exchanges.

Is DeFi staking safe?

Since DeFi is based on a decentralized network without a central authority, risks associated with DeFi staking are quite low. However, hacker attacks or market turbulences can have a negative impact on your potential profits.

Is DeFi staking profitable?

DeFi staking can be very lucrative depending on what DeFi platform you choose with APYs reaching up to a dew dozen percentages. However, more is not always better. Take into account all risks and drawbacks of each platform before deciding where to invest.

What's the difference between POS staking and DeFi staking?

PoS staking and DeFi staking are very similar. DeFi is based on PoS consensus mechanisms, and only Proof-of-Stake cryptocurrencies can be used to earn staking income. However, DeFi also allows for yield farming, i.e. earning passive income by pooling coins into liquidity pools on DEXs.

Is DeFi staking interest paid out daily?

Interest payouts are depending on the cryptocurrency and DeFi platform you use for staking. For example, Algorand (ALGO) features a daily payout rate, Cosmos (ATOM) a 7-days payout rate, Ethereum a daily payout rate, and Tezos (XTZ) a 3-days payout rate.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of cryptoapexpro. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. cryptoapexpro recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.