U.S. stocks seesawed last Monday with the major averages hitting their lows of the day after FED Chair Jerome Powell said “inflation is much too high” and pledged to take “necessary steps” to bring prices under control. He noted rate hikes could go from the traditional quarter-percentage-point moves to more aggressive half-basis-point increases if necessary, during a speech made at the National Association for Business Economics on Monday.

However, in the days following, stocks managed to find their footing and climbed higher, with all three major US stock averages notching their second consecutive winning week. The Dow ticked up 0.3%. The S&P 500 gained 1.8%, and the Nasdaq rallied nearly 2% by the end of the week.

A point worth noting is that the S&P 500 is now up about 3.9% higher in March, more than erasing its losses since Russia invaded Ukraine late last month. This underscores the resilience of the stock market as economic numbers released recently have showed that the growth in the US economy is still going strong despite geopolitical threats and rising interest rates.

The benchmark 10-year Treasury yield touched a fresh multi-year high of 2.5% as investors priced in a more aggressive rate hike cycle.

Oil had its first weekly gain in three weeks as, while the EU continued to debate how it can decrease its reliance on Russian energy exports, Saudi Arabian energy assets came under missile attacks that destroyed much of Saudi’s oil inventory. The geopolitical issues that continue in Saudi Arabia could lead to supply reductions and put upside pressure on oil prices. The WTI Crude rose 5.7% for the week while Brent Crude closed a whopping 10% higher. However, both Oil gauges are starting the new week lower by almost 4% as Shanghai has just announced a nine-day lock-down to try and contain the surge in COVID-19 cases there. With one of the world’s largest consumers of oil shut, demand for oil could fall significantly in the near-term.

Precious metals edged higher after Russia said that it would accept only Rubles, Gold or BTC as payment for its oil and gas supplies to “unfriendly” nations on Thursday. Both Gold and Silver edged up 2% for the week on the back of the news, but are also opening the new week a weaker.

On cryptocurrencies, BTC price stayed firm and even managed to move higher partly due the same Russia news. With BTC price staying strong, altcoins took the chance to shine, with positive news headlines sending some token prices up around 20% for the week. On average, crypto prices were higher by about 10% by the end of the week, and managed to move even higher on Sunday night as the price of BTC broke the $45,000 resistance and liquidated some $700 million worth of BTC shorts in a squeeze that sent the price of BTC briefly hitting $47,800.

BTC: The Good News Just Keep Coming

Last week came several positive revelations that will benefit the price of BTC, which will in turn spill over to the altcoin market.

First off at the start of the week, the Terra Network announced that the LUNA Foundation will be buying $10 billion worth of BTC to set aside as the reserve fund for its stablecoin UST. The Foundation will be buying $3 billion in the immediate future, while the other $7 billion will be at a later stage. While the impact on LUNA is unclear, this certainly is fantastic news for the price of BTC, as a $10 billion purchase at current price would effectively take up 10% of the supply of BTC, intensifying its dwindling supply which would in turn drive the price of BTC higher. As at the time of writing, the Foundation has accumulated more than $1.3 billion worth of BTC, or 27,790 units, and will still have another $1.7 billion to buy in the immediate future.

On top of the LUNA Foundation purchase, the El Salvador Bitcoin fund has also seen $1.5 billion worth of interest even though the fund only planned to raise $1 billion. While the launch of the fund has been pushed back to September, it did not sour the market mood.

Secondly, Wall Street institutional investors are showing a lot more optimism in crypto assets, with Goldman Sachs revealing that 60% of its respondents in a crypto survey expect to increase their crypto holdings within the next one to two years.

Goldman Sachs itself even said on Monday that it has just carried out its first ever over-the-counter (OTC) crypto options trade with Galaxy Digital, as it expands its cryptocurrency offerings. According to experts, this is a big step forward in the adoption of crypto assets which could lead to widespread adoption of BTC among big investors, which has already started happening.

The world’s largest hedge fund, Bridgewater Associates, has revealed that it is planning to invest in an external vehicle that is linked to the price of BTC. While this is not a direct investment in BTC, investing in a derivative nonetheless shows the firm’s optimism on BTC’s price. Even Blackrock’s Larry Fink said that he thinks the Ukraine-Russia war would accelerate the adoption of cryptocurrencies globally.

On top of the above news, the second largest bank in Israel, Bank Leumi, also said that it will offer cryptocurrency trading, starting with BTC and ETH, before expanding its offering later this year.

With very positive news, BTC burst pass $42,000 to first hit a high of $43,400 mid-week. This positive momentum has been made even stronger after Russia announced on Thursday that its sale of oil and gas to “unfriendly” nations would now have to be paid in either Rubles, Gold, or BTC. This, plus news of the LUNA Foundation’s purchase, led the price of BTC to finally break the $45,000 resistance that has been putting a lid on BTC’s price in recent times.

Invest in crypto at the same time as funds

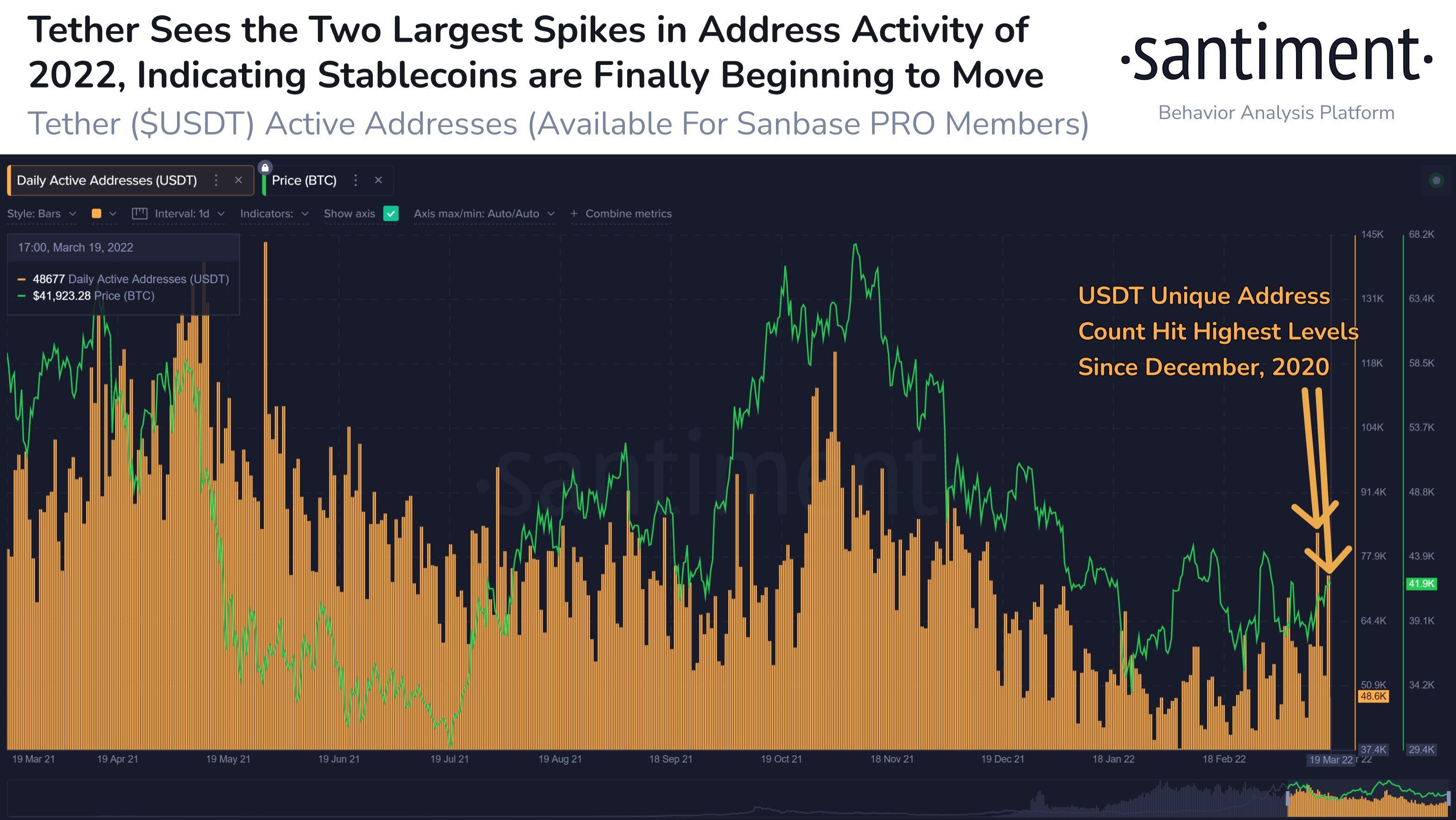

Large Tether Movements Prelude BTC Bounce

Early last week, USDT movements showed that Thursday (83,000) and Saturday (74,000) had the two largest activity days of 2022, where the largest number of addresses interacted with the network. When this happened in the past, upward movements in crypto prices followed.

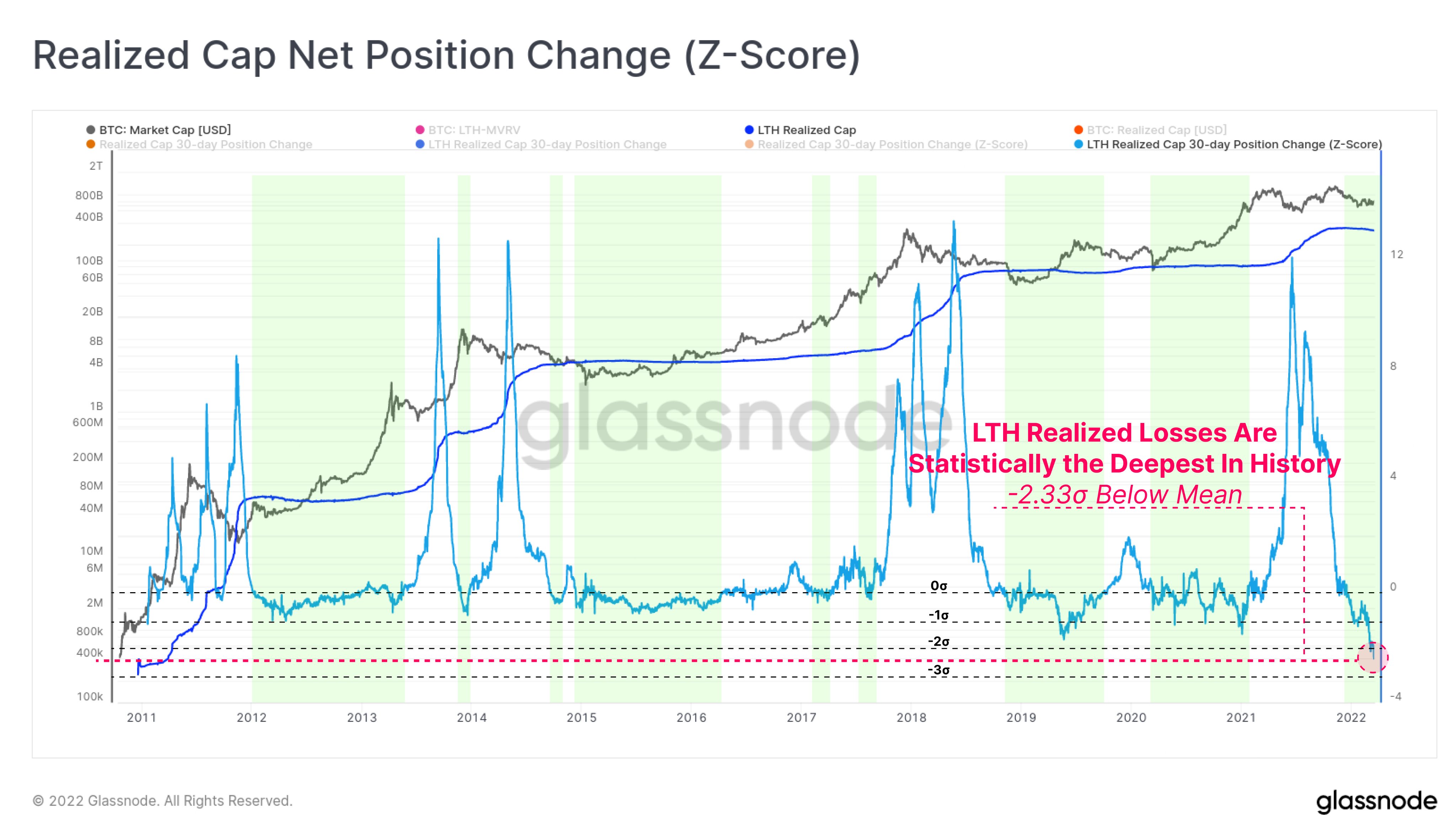

BTC Long-Term Holders In Biggest Loss

Another indicator that would have anticipated a bounce in the price of BTC is the LTH Loss.

Long-term Holders (LTHs) of BTC are now selling their precious stash at the deepest loss in history, as can be seen in the Z-score chart below.

Using the 30-day change in LTH Realised Cap, we can calculate the magnitude of their realised monthly losses on-chain. Long-term holders selling at a big loss is usually a good contrarian indicator that prices could move higher, and it did.

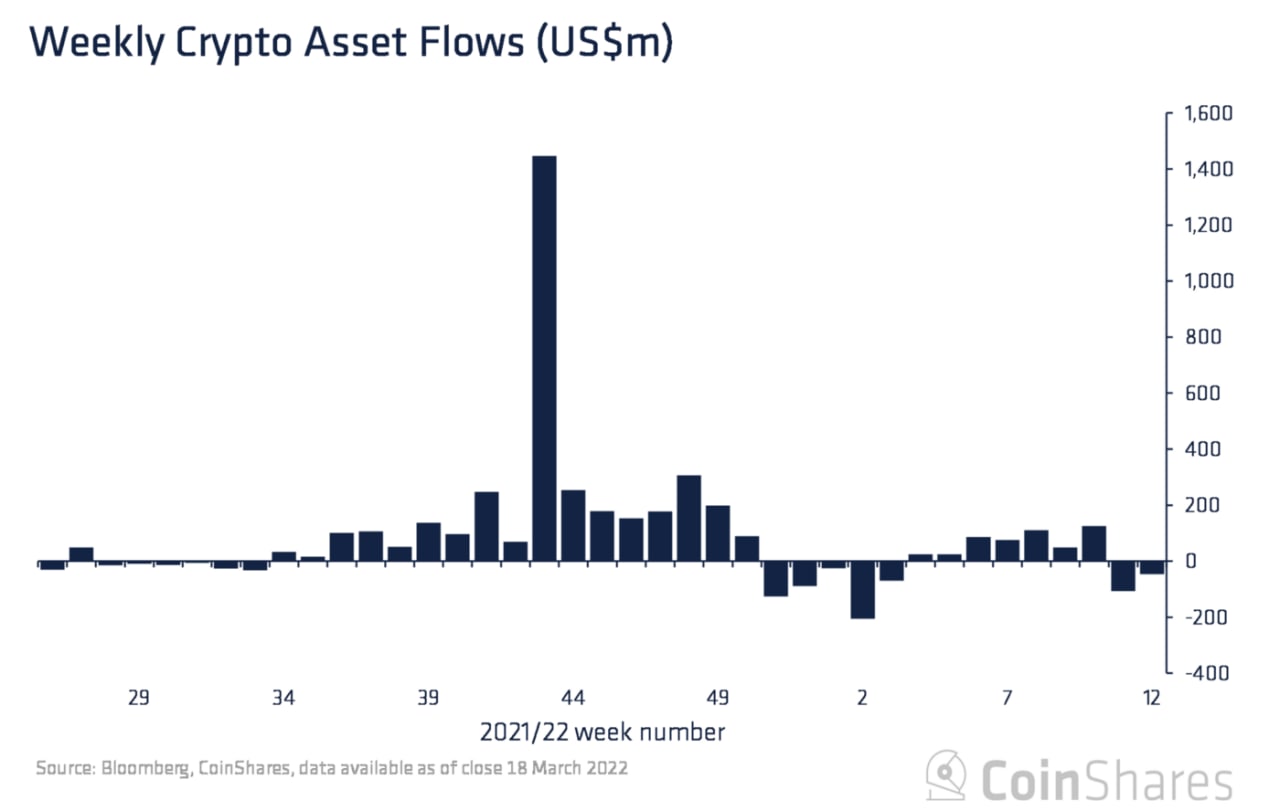

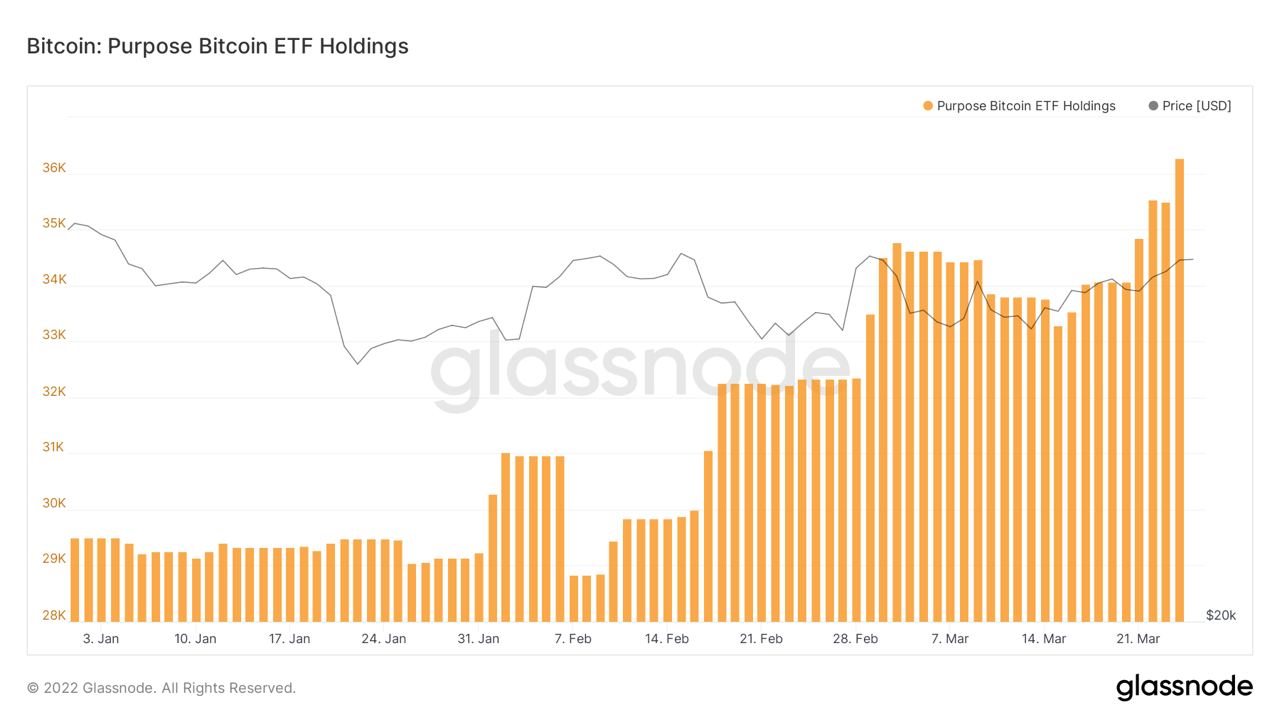

Crypto Funds Saw Outflow While ETFs See Inflow

Digital asset investment products saw outflows for the second consecutive week, totalling $47m last week, with outflows predominantly coming from North American providers.

However, the Purpose BTC ETF from Canada witnessed large inflows last week. This could mean that while investors in the USA were uncertain about the prospects of cryptocurrencies in the near-term, investors in Canada are very bullish and are piling it on.

Investors Holding ETH For Longer

ETH Mean Coin Age is climbing steadily, implying that the accumulation of ETH is ongoing and holders are holding it for a longer and longer period, which is a good sign for price since these holders are less inclined to sell at short-term up swings in ETH’s price since they seem to want to hold it for long-term.

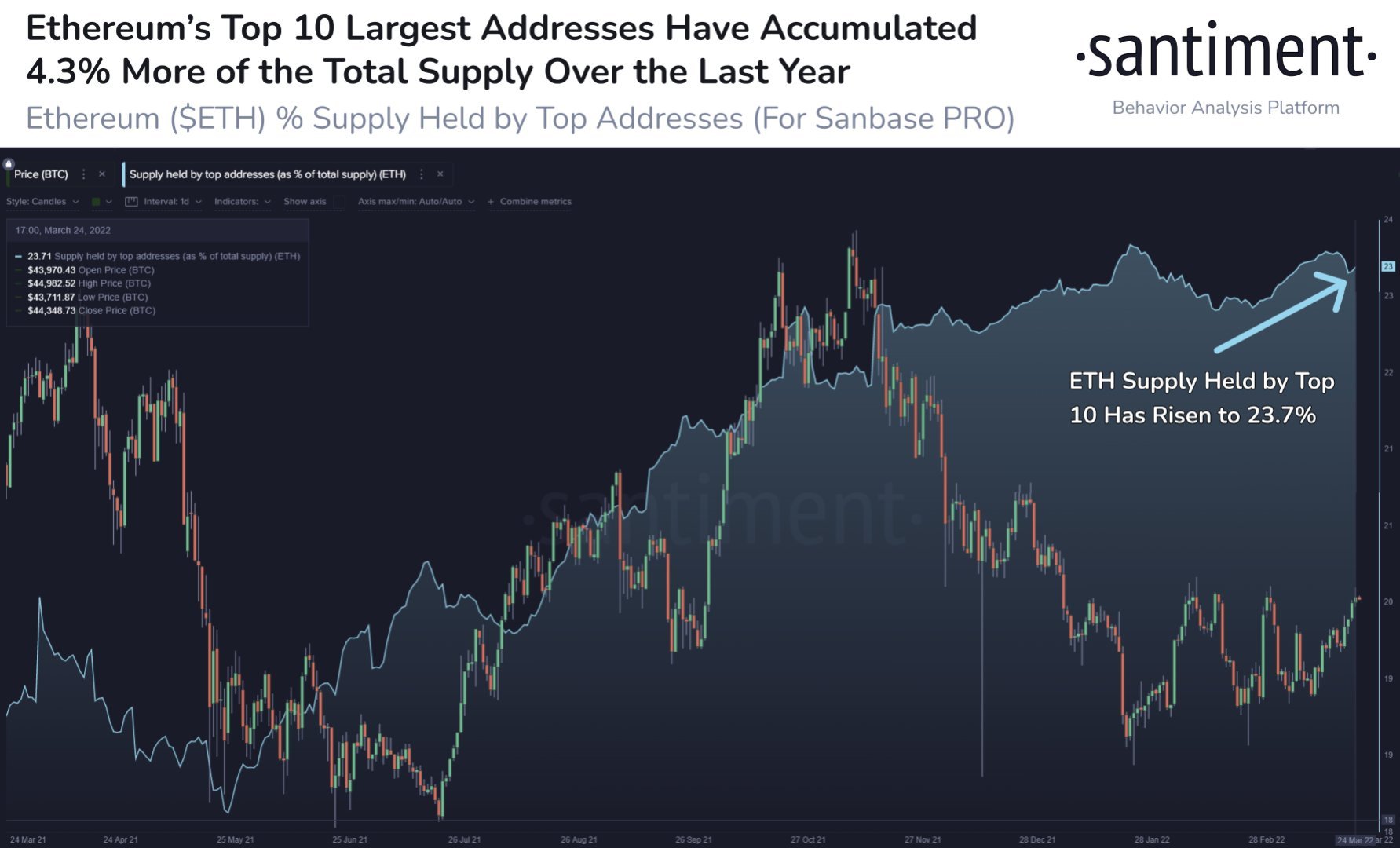

One group of long-term holders that are accumulating are the ETH top ten whales. These addresses currently hold 4.3% more of the total supply than they did one year ago today, and 23.7% of all ETH held by these wallets remain very close to the 5-year high levels that it first breached in late January. After some selling witnessed then, the top ten whales have begun to reaccumulate back their ETH since the onset of the Russia-Ukraine war and are very close to the amount they had back in January.

BTC’s Positive Energy Spills Over To Altcoins

On the back of good movement from the top two cryptocurrencies, altcoins had an even better week. Leading meme coin DOGE rose by 20% amid news that Bitcoin of America has added Dogecoin to its crypto ATMs across the country.

However, the token of the week was ADA, as it rocketed up 40% after Coinbase added staking for the crypto asset. The token’s gain is coming against a backdrop of more capital flowing into the Cardano ecosystem.

The total value locked (TVL) inside the Cardano protocol surged from nearly $130 million at the beginning of this month to over $421 million (including staked governance tokens) currently, its highest level to date. Despite the large growth, the network’s TVL still pales in comparison to that of its direct rivals in DeFi, including ETH and SOL. According to data, the two boast an eye-watering $120.71 billion and $7.3 billion respectively. This however, could also mean that the Cardano ecosystem has a lot more room to grow, and thus, its token could have more upside potential than the current leaders.

A check on large transactions on the Cardano blockchain which previously was a good indicator of price tops, did not show up any significant selling pressure, which is good news for the sustainability of ADA’s current price run.

Trade ADA and SOL on Crypto Apex Pros

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Crypto Apex Pros. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Crypto Apex Pros recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.