The dam wall is yet to break for Bitcoin as the major cryptocurrency has still not been able to crack past the all important $20,000 mark. Instead there has been some consolidation across the Bitcoin, and other cryptocurrency markets.

Bitcoin is happily sitting in the $19,000 category, and ETH has dropped below $600, but the major coin has faced some volatility along the way which it looks like it has managed to weather. Most of the top 10 coins are taking their cue from that and also consolidating.

The consolidation and sustained pressure of staying above $19,000 looks like it has a lot to do with a few factors , mostly around the mainstream adoption of crypto set for 2021. From Blackrock and Grayscale increasing their push, to S&P Dow Jones Indices announcing it will be launching a Crypto Index in 2021.

There is a lot of news of mainstream adoption bubbling under and getting ready to break through in 2021, and with the coin on the precipice of entering uncharted price territories, it will be an interesting short to medium proposition for Bitcoin.

Further from cryptocurrencies and more towards the traditional markets, the looming potential of another stimulus injection for the US economy is playing its part. Expectations of a slide have been shrugged off and poor performances in certain areas have not come to be, but continued Covid-19 pressure has the need for this stimulus rising, and an expectation that the bill could pass this week.

This is also propping up the Gold market, but in Europe, there monetary decisions made at the ECB this week could cause that price to stumble somewhat. Will Bitcoin start its next rally after breaking $20,000 this week, and will traditional markets follow suit for different reasons? Read the rest of our weekly market research report to find out.

Bitcoin Looking For A Reason To Break Out

Last week was relatively quieter compared to previous weeks, especially within the crypto markets as BTC consolidated around $19,000 and ETH at below $600. After creating a new ATH of around $19,900 with a very dramatic $2,000 move on Monday, $20,000 proved too hard to tackle and BTC fell to near $18,000 levels twice in the week, only to be bought up again.

BTC is currently consolidating between $18,700 and $19,400. Every time BTC tried to break $19,400, sellers emerged to bring prices down.

As BTC and the top 10 altcoins continued to consolidate, the smaller altcoins started rising, with DeFi tokens like Sushi and YFI gaining attention due to merger announcements and subsequently rose 20-40%, only to reverse most of their gains towards the end of the week.

BTC continues to gain popularity with institutional investors, with Blackrock now saying that BTC has caught their attention and that the cryptocurrency market can possibly evolve into a global asset class. Indeed, this evolution is happening as we speak, with S&P Dow Jones Indices announcing on Thursday that it will be launching a Crypto Index in 2021 that encompasses 550 crypto assets.

Crypto is going mainstream in 2021 and looks likely to attract more institutional investors with more coverage by traditional finance players.

Meanwhile, before more institutions join in the chase, Grayscale continues to add to their BTC holdings, purchasing around 13,000 units during the BTC pullback last week. It is looking like every BTC pullback is being bought by Grayscale.

Data shows that BTC miners, older BTC whales and smaller retail hodlers have begun selling BTC, which traditionally ought to be bad news for the price of BTC. However, all that selling has been well absorbed by institutional investors with far deeper pockets to the extent that the price of BTC does not seem to be falling.

In November alone, Grayscale bought twice the amount of BTC mined during the same period. Together with the consistent purchase by Square and Paypal, a shift in the investor profile from smaller individual holders and miners to large institutional ownership appears to be happening.

For instance, MicroStrategy disclosed that it added 2,574 units of BTC last week while the old hodlers were selling. MicroStrategy now owns a total of 40,824 BTC after this purchase. This shift in my opinion, is good for the price of BTC because these new institutional whales have deeper pockets and are longer term investors than the average Joe and miners who need to sell to pay for expenses. BTC is becoming an asset owned by the rich who are less likely to trade it.

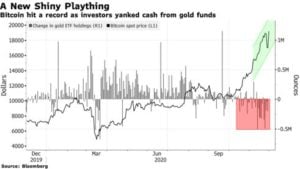

According to JP Morgan, the chase for BTC among the more well-heeled is so intense that some family offices have sold their Gold ETFS for BTC. Gold ETF is seeing outflows in the region of 93 tonnes at the same time that AUM is rising for BTC Trusts like Grayscale, with more of such funds in the pipeline next year.

Even long-time crypto critic and $631 billion asset manager, Fraser-Jenkins, is advising clients to add BTC into their investment portfolios.

More Moves To Mainstream BTC

In another move that will help bring cryptocurrencies mainstream, the Acting Comptroller of Currency of USA, Brian Brooks, mentioned that more clarification actions will be announced for the nascent market in 6 to 8 weeks, which will be beneficial for the market.

Meanwhile, ETH 2.0 had successfully launched on 1 December and 1 million ETH have already been locked-up in ETH 2.0 staking. These ETH will be locked-up for a couple of years and will not be available for sale in the market. This positive news for ETH does not seem to add any upside to its price, with sellers emerging several times once price touched around $630.

A check with on-chain data revealed that ETH miners too have been selling their ETH stash throughout this rally since late November. Miners balance, which shows the combined ETH balance of addresses belonging to Ethereum mining pools, have been falling rather quickly with the spike in ETH price since November.

In a move to perhaps attract more investors, Grayscale Ethereum Trust announced that it has declared a 9-for-1 split of the Trust’s issued and outstanding common units of fractional ETH shares, lowering the value of each share while increasing the total issued shares.

Grayscale’s ETH holding has also increased by about 200,000 units last week to 2.8 million. Even though the uptick in ETH purchase is not as intense as that of BTC, Grayscale expects their institutional clients to start looking at acquiring ETH as well on top of BTC.

Traditional Markets Play A Waiting Game

As for traditional markets, news of the bipartisan stimulus plan of $908 billion close to being agreed by US lawmakers put a bid under the markets, with the stock market shrugging off worse than expected economic data on Wednesday and Friday.

The Non-farm payrolls for November rose by 245,000, far worse than the expected 469,000. With COVID cases surging in the USA, the December data is expected to be worse, signalling the great urgency of a stimulus bill of any amount to be passed in the shortest time possible.

It seems the stock market will be in a holding pattern until news of the stimulus bill is passed, which may come soon as there is also a 11 December deadline to pass a $1.4 trillion budget or risk a shutdown of the government. Traders are expecting both stimulus and budget bills to be passed together before the end of this week.

With a stimulus bill expected to be forthcoming, the gold market recovered last week, bouncing off a $1770 support end to the week at $1838. This comes close to a resistance at $1860 which may halt the gold rally for the time being.

However, the price rebound may also be a bullish flag consolidating for a push towards $1920, so traders need to watch out for price action this week to determine if gold will start to stage a more sustainable rebound or if prices revert back lower. Thursday’s ECB meeting may be a key event to look out for.

Information provided in Crypto Apex Pros’s market report includes information provided by Kim Chua, Lead Market Analyst for Crypto Apex Pros, in addition to charts from various data sources.

*Disclaimer: Price information is averaged to accommodate the high volatility of the assets and is as close to accurate at time of print as possible.

About Kim Chua, Crypto Apex Pros Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Crypto Apex Pros. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Crypto Apex Pros recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Crypto Apex Pros. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Crypto Apex Pros recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.