There was a lot of anticipation around the ECB announcement of its stimulus program and the outline of the pandemic relief program it had in mind and how that would impact the markets. However, this announcement did very little for the traditional markets.

The Euro did however manage to rally back against the USD after falling briefly around the announcement, but the rest of the markets are mostly in consolidation mode ahead of the year end and the festive period.

In the cryptocurrency ecosystem, the price of Bitcoin looks to also be in consolidation as it fails to break above the $20,000 but is managing to stay ahead of the $19,000 mark. However, the overall outlook is positive for crypto as more and more mainstream adoption seems to be happening almost on a weekly basis.

Other than Bitcoin, there is still some excitement around XRP following the Spark Airdrop that saw XRP holders receive equal amounts of SPARK. The price of XRP did fall as expected, but only to $0.49 at the time of the snapshot.

Will there be much more action across any markets as the world heads towards the end of the year? Read the rest of our weekly market research report to find out.

ECB Announces 1.85 Trillion Euro Plan

Last week’s most anticipated event was the well-telegraphed ECB announcement of its stimulus measures. The ECB will increase the size of its pandemic emergency purchase programme (PEPP) by 500 billion euros from 1.35 trillion to 1.85 trillion euros and will push back the end of its main crisis-fighting tool from next June until at least March 2022, while reinvesting any proceeds until at least the end of 2023.

However, this news failed to bring about much cheer to the traditional markets as European stocks remained sideways while in the USA, a worse than expected unemployment claims number took US stocks slightly lower.

Stocks seem to be a standstill while optimistically waiting for results of the US stimulus bill, which has been continually delayed. Stock indices are at much similar levels as they were a week ago, with only the Nasdaq slightly weaker due to news that The Federal Trade Commission (FTC) is trying to break up Facebook and possibly other tech titans, causing some investors to take money off large US tech stocks.

The EURUSD managed to rally back above 1.21 after a brief move below as traders unwound positions ahead of the ECB meeting. The GBPUSD recovered some ground with the Brexit negotiation deadline extended to trade at around $1.3310.

Gold prices however, took a turn for the worse as news of countries deploying the COVID vaccine continues to gain traction, lending to an unwinding of risk-averse assets. Outflows from investors switching from Gold ETF into BTC also added to the weakening Gold narrative.

The price of Gold failed to breakout from resistance of $1860 and has moved back lower, opening the possibility of retest of previous low at $1770.

This week has a crowded economic calendar as 3 Central Banks will have their final interest rate meeting for the year, with the US FOMC on Wednesday, MPC of UK on Thursday, and the BOJ of Japan on Friday. After these meetings, activities in the traditional markets are expected to start winding down for the year end holidays.

Bitcoin Stuck In A Range As Big Players Keep Buying While Miners Sell

Many sophisticated investors, including Ray Dalio who used to despise BTC, now think BTC is a good alternative or an even better inflation hedge than Gold. Every week, more institutions and Wall Street veterans are coming forward to talk about the importance of owning BTC.

MassMutual, a 156-year-old USA insurance firm, revealed last week that they had just bought $100m worth of BTC at an aggregated price of around $19,425 and are open to more opportunities within the crypto space. Meanwhile, MicroStrategy, who already owns around 41,000 BTC, disclosed that it has completed a $650m convertible bond sale to purchase more BTC, equivalent to around 36,000 BTC at current levels.

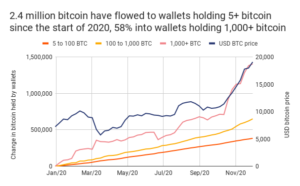

Data also shows that large wallets with more than 1,000 BTC are purchasing BTC most aggressively, with a spike coming in after October, proving that large institutions buying in the spot market are chasing up the price of BTC this quarter. 58% of all BTC flows are into large wallets containing at least 1,000 BTC. One high profile contributor to this increase is Grayscale, who continues to add 14,592 BTC and 131,254 ETH last week.

Source: Chainalysis

However, despite all that buying, BTC isn’t breaking above $20,000 yet. It continues to consolidate within the range of $17,500 and $19,500. While more institutional investors are singing praises of BTC, most market participants including miners and retail investors have a slight bearish bias.

Miners continue to sell BTC more aggressively, with the Miners Position Index (MPI) hitting a 3-year high above 8 on Thursday when a reading of 2 already implies miners are selling.

Mt. Gox Coins Raising Fears

The Mt Gox rehabilitation dateline on 15 December may have created the urgency for miners to sell ahead. Mt Gox Trustees is supposed to return around 150,000 BTC to Mt Gox clients on 15 December. It is unknown if these clients will sell or keep their recovered BTC, with this unknown hanging giving the price of BTC a slight bearish bias in the near term.

We may need to wait a couple of days post the Mt Gox BTC return date to determine what impact it will have on BTC price. In the meantime, miners and institutions continue to battle it out, with an increasing number of institutions getting into the fray every week, buying on every dip. In the meantime, BTC continues to find selling pressure into $19,500 but may eventually break higher as its price action over the weekend suggests.

Spark Airdrop Over But XRP Interest Remains High

Meanwhile, with the Snapshot date on 12 December over for the Spark Airdrop, the price of XRP fell to around $0.49 as some traders who bought for the airdrop started to sell their XRP.

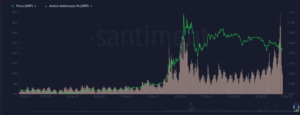

However, the drop is not as intense as many anticipated and has since rebounded to above $0.50. In fact, the price of XRP did not fall despite the sale of 29.5 million units of XRP tokens by its co-founder Jed McCaleb, on 6 December. This shows investor confidence in the future of XRP. Its active daily addresses have been increasing at alarming levels since the end November and, although having gone down post snapshot for Spark Airdrop, are still growing at heightened levels compared to before.

This could mean that buyers may not necessarily be buying solely for the airdrop, but are investing in the growth of the XRP ecosystem.

RippleLabs is currently ramping up adoption activities for XRP by setting up business units in Europe, Asia, and Latin America. Former Goldman Sachs hedge fund chief Raoul Pal’s positive comments about XRP last week may also be one factor behind investors’ confidence since Raoul Pal is a very well-respected figurehead within both the traditional finance as well as crypto space.

More attention could be coming for XRP soon as it is one of 4 cryptocurrencies that South East Asia’s largest bank, DBS Bank’s new digital exchange supports. DBS Bank is launching its digital exchange this week in a bid to gather cryptocurrency business from institutions as well as its many high net worth clients across Asia.

The exchange will include custody services as well and will initially support 4 cryptocurrencies, namely, BTC, ETH, BCH and XRP. With XRP potentially to benefit from a flood of fresh money due from DBS Bank’s accredited investors, the price of XRP should be able to recover and move higher in the days ahead.

Information provided in Crypto Apex Pros’s market report includes information provided by Kim Chua, Lead Market Analyst for Crypto Apex Pros, in addition to charts from various data sources.

About Kim Chua, Crypto Apex Pros Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Crypto Apex Pros. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Crypto Apex Pros recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.