After Bitcoin managed to break its own all-time high and top out at $67,000 things have settled down a little bit with the major digital asset. However, this has allowed for other cryptos in the space to rise up and set some impressive milestones.

Bitcoin was not the only one breaking records in the past few weeks. Ethereum hit its own all-time high off the back of Bitcoin. It managed to go as high as $4,400 after Bitcoin consolidated, but it was still not the most impressive altcoin.

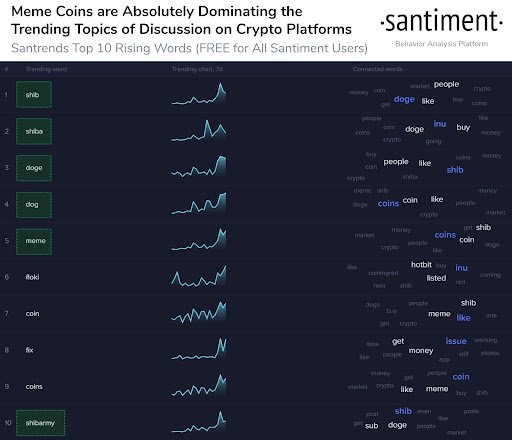

A lot of eyes have been on meme coin spin off SHIB. SHIB saw a 100% move in three days and had trading volume 5x that of BTC, making it the most traded token for the entire week. SHIB even managed to get into the crypto top ten, beating incumbents DOGE, DOT, and XRP to take the number seven spot.

Things are still really positive across the crypto markets, with good news still coming through, such as the Federal Deposit Insurance Corporation (FDIC) says that regulators in the USA are exploring a “clear path” to allow banks and clients to hold BTC and other cryptocurrencies.

Speaking of the US, the US stock market closed at yet another set of record highs last week as Wall Street looked past disappointing results from major companies to wrap up its best month of the year.

Both Amazon and Apple missed earnings expectations but the stock market has been raking in records amid solid earnings from other companies even with global supply chain concerns. For instance, oil companies reported solid earnings as a key beneficiary of rising oil prices.

However, the main reason for the stock market to be buoyed by positivity was due to the progress of the infrastructure bill. On Thursday, President Biden announced a framework for a $1.75 trillion social spending deal. The agreement, which is expected to make it easier to pass the separate infrastructure spending bill that is currently stalled on Capitol Hill, came in lighter on spending and taxes than earlier proposals. Despite this, the prospect of having some spending bill passed instead of none garnered optimism from market participants.

All three major US stock averages posted their fourth positive week in a row. The Dow was up 0.4%, the S&P was 1.3% higher, while Nasdaq was the best performer, closing the week with a 2.7% increase. On a monthly basis, the data looks even better. The Nasdaq gained 7.2% for October, while the S&P 500 gained 6.9%. The Dow rose 5.8% for its best month since March.

US 10-year Treasury yield remained calm, unchanged at 1.56% for the week.

Oil was a tad weaker, falling 2.8% for the week after a phenomenal October run. Gold and Silver retraced, with Silver falling back below $24 and Gold below $1,800.

The FED meets in the middle of this week, with its impact possibly greater than all other meetings this year as there is a chance the FED could announce the start of the tapering of bond purchases since it is the second last time the FED will meet this year. Whether or not tapering starts with this meeting, some volatility could result in the markets.

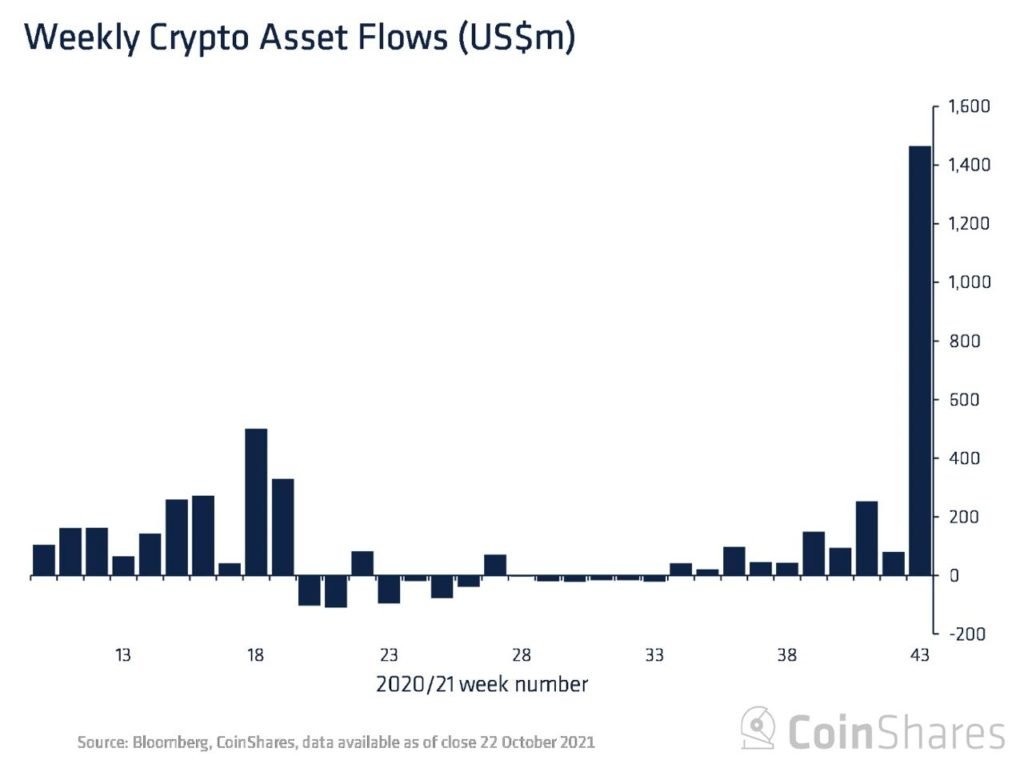

While traditional investors still focus their investments in the stock market, some interest in alternative assets like cryptocurrencies are beginning to take place after BTC carved out a new ATH as crypto assets have started to see large fund inflows. The week before saw the largest inflow to crypto funds after the SEC approved a BTC ETF. Inflow saw more than a 10-fold increase to $1.47 billion from its usual $100 million.

However, funding rates have started to go up early week with an increase in leverage as altcoins like FTM and SHIB continued to break ATH after ATH. Froth in the market started popping and as traders sold their tokens to chase SHIB, the entire crypto space with the exception of SHIB fell around 15% as the price of BTC broke below $60,000. Around $500 million had been liquidated from the market in 12 hours and for the entire day, around $900 million had been liquidated. Despite the dump taking the price of BTC to a low of $57,800, the price of BTC managed to inch upwards of $60,000 by the end of the week due to dip-buyers.

Dip Buyers Keeping BTC Above $60,000

Dip buyers were plentiful as even El Salvador revealed that it had bought another 420 BTC during the mid-week dip. Other than El Salvador, miners were also seen to be actively increasing their BTC reserves.

The BTC miners’ reserve started spiking up the moment the price of BTC dropped to around $60,000.

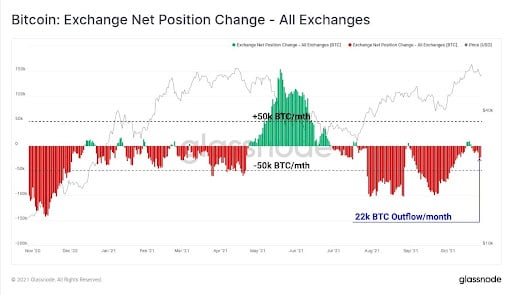

As a result of dip buying, exchanges continued to see BTC being bought and withdrawn, taking the total BTC outflow for October to more than 22,000 BTC.

Crypto Positive News Continues to Pick Up

In spite of the short-term volatility in prices, news flow continues to be bullish for cryptocurrencies.

Dubai finance watchdog, Dubai Financial Services Authority (DFSA), approves listing of Bitcoin Fund, QBTCu.TO, a closed-end investment vehicle based in Canada, on Nasdaq Dubai. The fund will be available to investors of all levels from big banks to individual traders.

The DFSA is attempting to establish itself as an innovative regulator for the region by focusing on fresh technology and innovative financial solutions that may help drive economic growth.

Adoption in the USA is also gaining traction, as per a Reuters report, the Federal Deposit Insurance Corporation (FDIC) says that regulators in the USA are exploring a “clear path” to allow banks and clients to hold BTC and other cryptocurrencies.

Mastercard is also partnering with Bakkt to allow its customers to have greater access to cryptocurrencies, while Tesla has informed the SEC in a quarterly filing that it could restart the acceptance of cryptocurrencies for its services and products.

BTC Price Behaviour Confirms Commodity Status

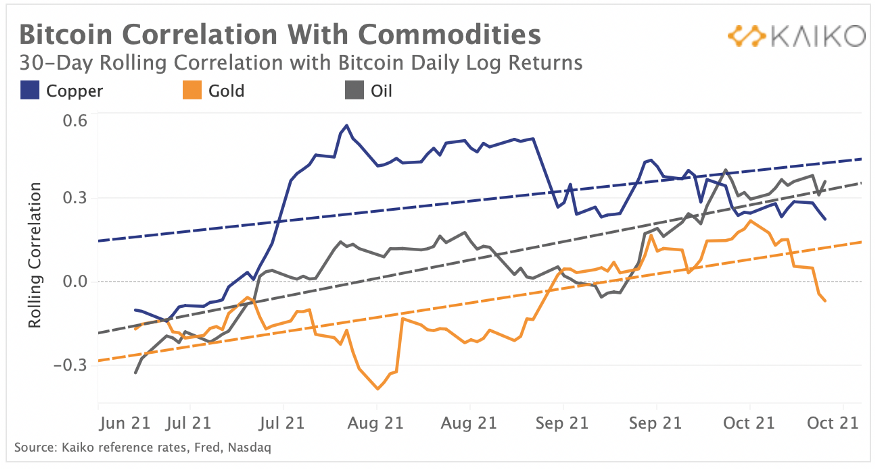

According to data, in recent times, BTC’s correlation with commodities has been climbing. BTC’s correlation with commodities — which historically perform well during times of unexpected inflation — has been on an uptick since the start of Q3. In the below chart, notice that BTC’s correlation with Copper and Oil has been increasing since September. Both Oil and Copper rose over the past few weeks on the back of growing demand and record low inventories.

By contrast, BTC’s correlation with Gold has been mostly negative this year despite briefly turning positive in September. According to a recent analysis by JPMorgan Chase, the perception of BTC as a better inflation hedge than Gold has been driving the recent price rally, rather than ETF euphoria.

In any case, the correlation with other commodities confirms the CFTC’s narrative that BTC is a commodity.

ETH Breaks ATH After Successful Altair Upgrade

After a successful upgrade on Wednesday to move closer to the aim of ETH2.0, the price of ETH finally broke ATH of $4,374 that has been capping ETH price since September. The Altair upgrade is one of the pivotal upgrades for Ethereum 2.0 and will change the Ethereum infrastructure from PoW to PoS.

Immediately post-upgrade, ETH saw a massive increase in token circulation to 1.74 million units of ETH, creating a bullish divergence between its usage and price, ultimately sending prices higher. ETH price has a habit of rising after each successful upgrade so traders are expecting higher prices in the days and weeks ahead.

Rotational Play Heating Up Altcoin Market

The most talked about topic amongst crypto investors last week was the “Dog Race”, where meme token SHIB saw a 100% move in 3 days and had trading volume 5x that of BTC, making it the most traded token for the entire week. In addition to that, SHIB even managed to get into the crypto top ten, beating incumbents DOGE, DOT, and XRP to take the number 7 spot.

Not letting the new dog get all the attention, the original dog meme token DOGE also sprang to life, bursting from $0.24 to a high of $35 over one day. Crypto social media had been abuzz with these dog tokens all week. Even other dog tokens like FLOKI and BabyDoge also saw significant rises amid the craze.

While other dog coins had started to cool off, SHIB continued to trade near its ATH even as a new theme came into play at the end of the week – the Metaverse.

Crypto hot-money has shifted to Metaverse-related tokens after Facebook revamped itself into a Metaverse company. Facebook unveiled its new strategy to transform itself into a metaverse ecosystem and renamed itself Meta. This news is very positive for the mass-market adoption of both crypto and the Metaverse as Facebook has more than 2 billion active users worldwide, out of which many have not been exposed to metaverse nor crypto. Tokens like SAND and MANA saw triple-digit gains after the Facebook revamp was announced. MANA in particular, rose 500% in 3 days but is now back lower.

Rotational play into different types of cryptocurrencies should continue to hog the crypto limelight this week and cause funds to move from one theme play to another.

One interesting token to keep in view is XRP. The number of addresses interacting on the XRP Ledger has increased significantly in the month of October despite a lackluster price action. Historically, these divergences inevitably lead to price upticks.

About Kim Chua, Crypto Apex Pros Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Crypto Apex Pros. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Crypto Apex Pros recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.